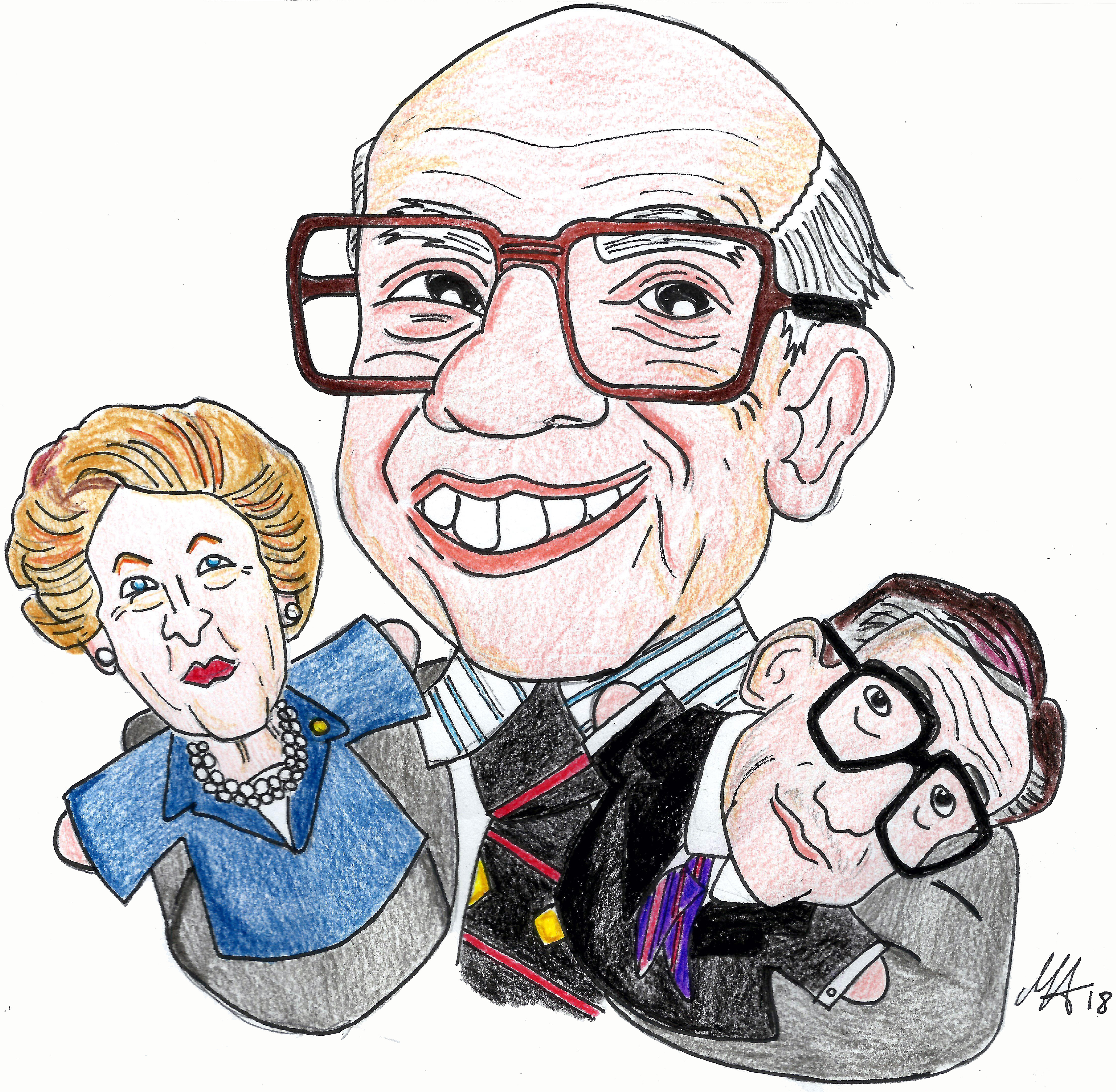

Summary of Gregory Mankiw and Ricardo Reis: “Friedman’s Presidential Address in the Evolution of Macroeconomic Thought”

Fifty years ago Milton Friedman delivered his presidential address [1] to the American Economic Association. His speech is the third most-cited presidential address, preceded only by those of Kuznets [2] and Schultz [3], with more than 7500 citations. Why has it been so influential? Friedman stressed his opinion, built over years of study of monetary theory and history, distinguishing what monetary policy could and could not do. In less than 17 pages, with a simple writing not common to most of economic papers, without any equation or complicated model, he challenged the mainstream thought, opening a new era in macroeconomic research.

In occasion of this anniversary, Gregor Mankiw and Ricardo Reis explore the state of the art at that time, the main points of the address and the consequences it had not only on the field but most importantly on policy in a recent paper, “Friedman’s Presidential Address in the Evolution of Macroeconomic Though”, published in the Journal of Economic Perspectives.

Looking back at the beginning of the 60s, the mainstream thought in macroeconomics was the Keynesian one, based on Hicks and Hansen’s simplification of the general theory: the IS-LM model as a building block, accompanied by the belief that the Phillips curve was an actual instrument in the toolkit of policymakers and finally that the long-run behaviour of the economy was the results of the sum of Keynesian short runs. The Keynesian approach to the short and medium run, corrected with the advance made by theorists, is still the starting point of any introductory course on macro, while most of students are initiated to long-run theory through the Solow growth model.

On the contrary of Keynes, Friedman was convinced that the long-run is the realm of classical economics and thus monetary policy, being neutral, cannot do anything to change real variable like the natural rate of unemployment which is pinned down by the characteristics of the market structure. Moreover, according to his view, the trade-off between inflation and unemployment is always necessarily temporary, as expectations evolve through time, frustrating central bank’s attempts. Milton Friedman’s definition of long-run was indeed the time horizon over which people become informed and align their expectations to the reality. The ground for the rational expectations revolution (and later the development of the RBC model) had been put in place, even though Friedman thought expectations were slow to adapt, sluggish rather than rational.

Following Friedman’s reasoning, central banks cannot take advantage of the Phillips curve infinitely to control real variables in the long run, as it will eventually disappear as expectations adjusts (it should be stressed that he did not consider feedbacks between inflation and unemployment in a fashion like the modern Taylor rule). Notwithstanding this view, and the fact that monetary policy is not timely but takes time to exert its effects, he was not a complete advocate of passive policy, as he believed that monetary policy and credit policy could be used to offset disturbances caused by other sources like fiscal policy (yes, he considered fiscal policy a disturbance, didn’t you know?). He finally proposed to use the rate of growth of some monetary aggregate as the baseline instrument of monetary policy, ruling out the exchange rate and the interest rate instead.

But decades have passed, and nowadays monetary policy could not be more different than that simple rule, with balance sheet policy, fine tuning operations and unconventional “weapons” used by central banks all around the world to cope with the crisis and impaired transmission mechanisms. Monetary policy today is mostly based on the interest rate instead, given its central role in asset pricing and as a driver of investment and saving decisions, and the paper explains the role of monetary policy today, digging into the current ideas which Friedman would have agreed with as well as those he would have opposed. Just to cite one, Galí and Gertler [4] point out the “significant role of expectations” in the transmission mechanism of monetary policy (which Friedman would be totally fine with), as opposed to “the importance for the central bank of tracking the flexible price equilibrium values of the natural levels of output and the real interest rate” which fosters the monetary policy activism criticized by the Nobel prize laureate.

The final section of the paper illustrates the “road ahead” and current research themes (and associated real world problems) which relate to Friedman’s theories. First, the natural rate hypothesis clashes against the stagnation affecting our economies, with the latter opening both to the competing views of hysteresis and shortage of aggregate demand. Second, the Philipps curve is still alive as a synonym of nominal rigidities and investigation of price and wage setting flourishes as that on expectations, recently driven by progresses in surveys and experimental/behavioural economics.

On the policy side, the effects of massive central banks interventions on the potential of fiscal authorities and their constraint and vice versa ask for a compelling understanding, as well as the role of liquidity in financial markets, the potential of macroprudential policy and finally the effectiveness of macroeconomic policy at the zero lower bound. As a matter of fact Friedman did not discuss the last two, which are today central issues in macroeconomic policy: the view that monetary policy could be ineffective and different instruments are needed as the interest rate approaches zero was Keynesian, and he did not reserved a role in macroprudential regulation to central banks. On the contrary, today it is recognized that monetary authorities should pay attention to credit variables as they are related to potential risks for financial stability and crises and ultimately to the potential functioning of the transmission mechanisms of monetary policy, in good and bad times.

Concluding, Mankiw and Reis article on the Journal is accompanied by two other related essays “Should we reject the natural rate hypothesis?” by Blanchard and “Short-Run and Long-Run effects of Milton Friedman’s Presidential Address” by Hall and Sargent, which further contribute to the discussion surrounding Milton Friedman’s inheritance.

[1] https://www.andrew.cmu.edu/course/88-301/phillips/friedman.pdf

[2] “Economic Growth and Income Inequality”, The American Economic Review, 1955

[3] “Investment in Human Capital”, The American Economic Review, 1961

[4] “Macroeconomic Modelling for Monetary Policy Evaluation.”, Journal of Economic Perspectives, 2007