Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Peer-to-peer home-sharing platforms such as Airbnb are a new phenomenon which many researchers consider to be responsible for significant disruptions in the housing market. Prior to the introduction of these platforms into the rental market, hotels were the primary supplier of short-term rentals, while residential properties almost exclusively operated on the long-term rental market. The introduction of short-term rental platforms like Airbnb, allows homeowners to choose either to supply on the short-term or the long-term rental markets. As a result, when residential properties are moved to the short-term rental market, the quantity of housing supplied on the long-term rental market decreases, inducing an upward pressure on long-term rents.

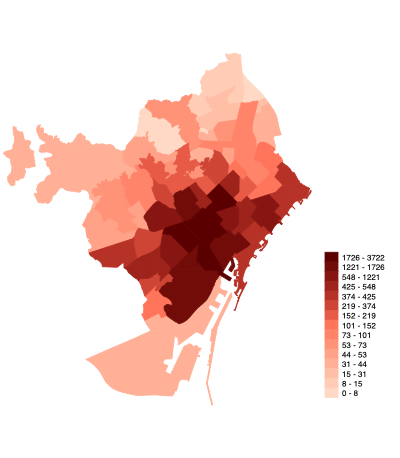

In our paper, we offer a novel approach to investigate the extent to which the expansion of the sharing economy is responsible for increases in long-term rents and prices on the housing market. To this end, we construct a theoretical framework for the housing market that allows for spillover effects between neighborhoods, and other local externalities caused by tourism. The model allows for the short-term housing market devoted to tourism to impact both long-term rental rates and housing prices. Using a panel of quarterly data on newly signed rental contracts and transaction prices in Barcelona from 2015-Q2 to 2018-Q4, we implement a fixed-effects spatial 2SLS method allowing for endogeneity in the variable which measures the presence of Airbnb.

Barcelona, which hosts the sixth largest concentration of Airbnb listings in the world, serves as a prime case study to investigate these effects because our dataset covers growth rates in contractual rental rates, transaction prices and the number of active Airbnb listings of 27.42%, 27.41% and 29.38%, respectively.

Key results

The theoretical model predicts that a change in the level of Airbnb activity might affect both long-term rents and housing prices. In fact, if negative externalities generated by tourists are sufficiently small, Airbnb leads to increases in long-term rental prices. Yet, these effects ultimately depend on the values of parameters such as the size of the stock of housing units and the level of externalities emerging from tourism. In addition, the model bears upon the effects of Airbnb on gentrification and displacement: we find that for a positive increase in the negative externalities generated by tourism, the proportion of homeowners renting in the short-term market will increase. As the degree to which residents are harmed by negative externalities increases, more of them will decide to abandon their neighborhood, reducing the local demand for long-term housing. As a result, rents will suffer a downward pressure, increasing the relative profitability of the short-term rental market for homeowners. Besides, this effect will be aggravated if the degree of inter-neighborhood dependence generated by externalities is high. Residents will be prone to move to other neighborhoods in which not only the presence of Airbnb is low, but also in which the penetration of this marketplace is low in the surrounding areas.

We refer to this process as Airbnb-induced gentrification. Similarly, if the profitability of renting a property on Airbnb increases, a similar process as the one we have just described above would arise, which would also lead to gentrification.

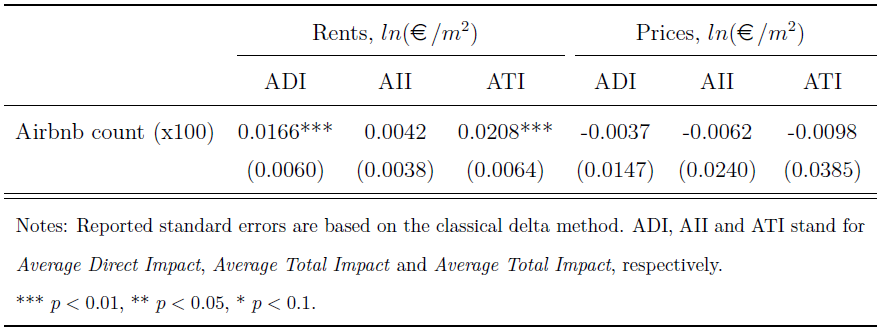

For another thing, our main empirical results show that Airbnb positively and significantly affects rents, even when accounting for spatial dependence and inter-neighborhood spillovers. In a given neighborhood (as classified in this paper), for every additional 100 Airbnb listings, rents increase by an average of 2.1% when indirect spillovers coming from adjacent neighborhoods are included. In particular, the direct effect of Airbnb within a given neighborhood accounts for much of this effect: the own-neighborhood effect is to induce a 1.7% increase in rents. The maximum average indirect effect found in the sample data accounts for 35% of the total effect. The implications of these findings are far reaching and suggest that spillover effects can indeed explain a large portion of rent increases. Likewise, we identify a potential bias in the previous literature in that the total effect is falsely interpreted as the direct effect, thereby misinterpreting the direct effect of Airbnb on long-term rents.

In contrast, our empirical results show that Airbnb has had no significant effect on transaction prices. The most plausible explanation for the non-significant results for prices is that homeowners do not believe that Airbnb is sustainable in the long-run, and therefore they do not adjust their predicted future cash flows when valuing their properties.

Finally, we believe that future research could delve into more detailed theoretical models, especially with respect to the price setting by homeowners in light of the establishment of Airbnb. Additionally, we think that making a distinction between direct and indirect neighborhood effects is vital in order to truly understand the dynamics of the housing markets, especially in the growing metropoles. Accordingly, we encourage scholars to further apply and develop spatial econometric methods that measure indirect spillover effects in studies related to housing markets.