Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2014. The project is a required component of every master program.

Rethinking Fogape: An Evaluation of Chile’s Partial Credit Guarantee Scheme

Authors:

Margarita Armenteros, Niccolò Artellini, Andreas Hoppe, Marco Urizar, and Bernard Yaros

Master Program:

International Trade, Finance and Development

Paper Summary:

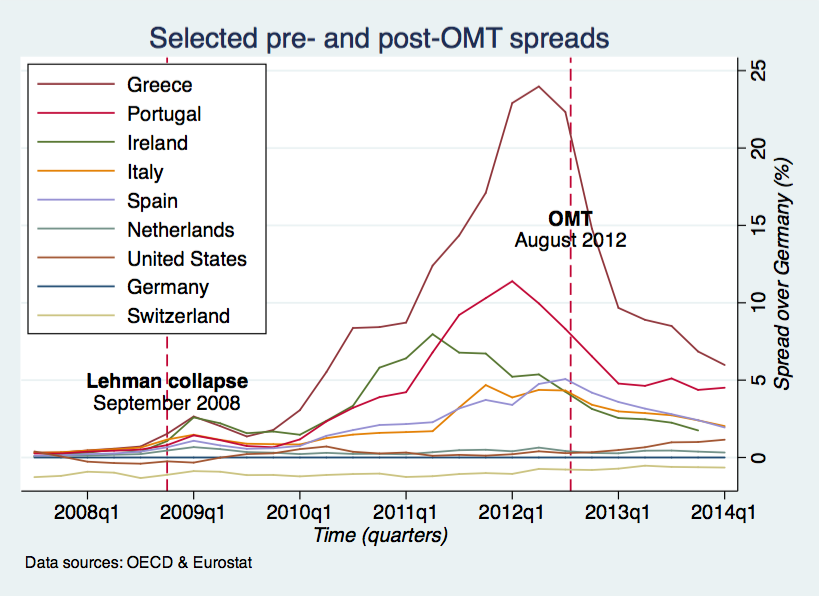

Small-and-medium enterprises (SMEs) often find themselves credit constrained due to a lack of collateral, limited credit history, and informational asymmetries that entail high monitoring costs for lenders. Governments around the world have introduced partial credit guarantee schemes (PCGS) to overcome these constraints and ease financial access for SMEs. These schemes aim to relieve credit-constrained firms by providing public collateral that reduces the risk borne by private lenders in the event of a default. In recent years, PCGS have been utilized as a way to protect SME lending in the backdrop of the global credit crunch.

Why are SMEs important? Any economy is dependent on the innovation, technological change, and job creation that new enterprises introduce, and in most cases, such firms are small in size. The role of SMEs in Chile is no exception. By 2009, the SME sector in Chile contributed to 20% of GDP, and the percentage of workers employed in SMEs stood at 56.4% in 2011. Nevertheless, Chilean SMEs have pointed to the fact that their difficulties in obtaining a formal loan rest with a lack of guarantees and high financial costs.

In 2000, Chile relaunched its public guarantee fund Fogape (Fondo de garantías para pequeños empresarios) with the goal of providing public guarantees for loans taken out by SMEs with private financial institutions. In 2007 and 2009, the government re-capitalized the fund by $10 million and $130 million respectively as a direct countercyclical response to the international financial crisis. Fogape is unique in the way by which it disseminates its guarantees into the credit market; it does so through an auctioning system that is designed to reduce moral hazard on the part of participating banks that bid for Fogape’s guarantees.

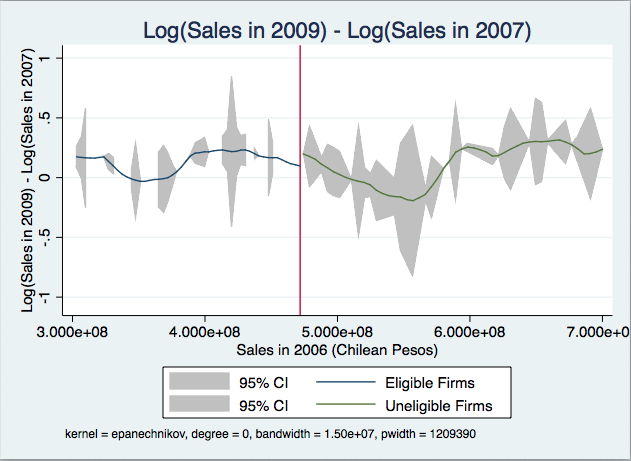

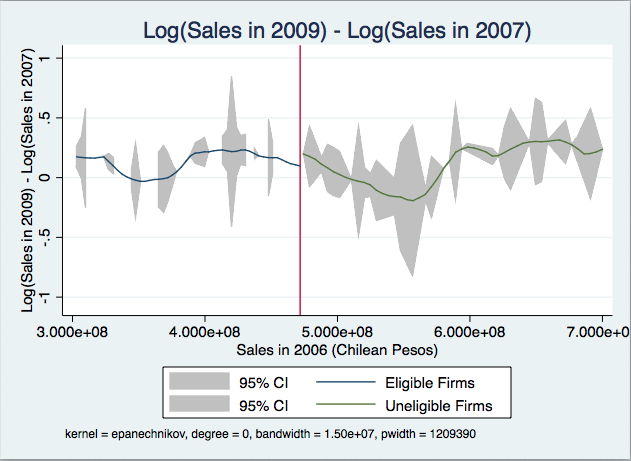

To assess econometrically the impact of Fogape on eligible firms, we used firm-level data obtained from two longitudinal surveys undertaken by the Ministry of Economy. We employed the strategy of regression discontinuity design (RDD) in which receipt of the treatment depends discontinuously on the value of one or more observable characteristics of the subjects. In our case, we exploited an arbitrary threshold of eligibility by which only firms with reported sales less than $750,000 are eligible for Fogape’s guarantees.

We estimated the intention-to-treat, or the effect of eligibility to Fogape on eligible firms vis-à-vis ineligible ones. In keeping with the literature on RDD, we restricted our sample of interest to only those enterprises whose reported sales fall within a distance h on either side of the sales cutoff of eligibility. Our robustness checks confirmed that eligible and ineligible firms at the margins on either side of the cutoff were not systematically different in key baseline characteristics.

We selected the following outcome variables in which we expected to observe a change due to Fogape’s presence: the log difference of sales from 2007 to 2009; debt-to-equity ratio in 2009; profit margin in 2009; and long-term debt over total debt in 2009.

We did not obtain any statistically significant results, suggesting that the effect of eligibility is neither positive nor harmful to the various performance indicators of the eligible enterprises in our sample of interest. We found that eligible firms within our bandwidth h, ceteris paribus, experienced less proportional change in their sales from 2007 to 2009 than ineligible ones. We had expected to see firms that are eligible for credit guarantees to have higher sales growth because of the investment in working capital and productive assets that such access to credit would allow for. The finding from our RDD analysis that eligible firms had less debt-to-equity in 2009 than non-eligible ones was equally puzzling. We expected eligibility to have increased their debt-to-equity ratio vis-à-vis similar ineligible firms because of the loans they are getting through Fogape. Finally, the result that eligible, surveyed firms had less long-term to total debt in 2009 than ineligible ones within our bandwidth h was also contrary to our expectations. Fogape has put emphasis on its allocation of guarantees to long-term credit, which led us to believe that there would be a corresponding increase in the long-term over total debt ratio of eligible firms.

We started with the premise that SMEs are credit constrained, which validates Fogape’s raison d’être in the economy as a provider of credit. We also assumed that this guaranteed credit would be used for productive investments, which would then be reflected in firm profitability and sales growth. Why do we find no evidence of Fogape’s impact during the period of 2007 to 2009? Are firms receiving Fogape-guaranteed loans not truly credit constrained? Or are lenders substituting Fogape guarantees for private ones? Do these firms have the expertise or productivity to undertake successful investments? In the survey used in our study, it is possible to identify 369 firms that received Fogape guarantees for a secondary loan in 2009. Out of these firms, 40% obtained their primary loan using physical collateral and 18% using private guarantees, thereby hinting at a substitutability problem. However, it is still not possible to say that Fogape users, which already had access to the fund or other sources of credit, were not credit constrained to begin with. We suggest more research be carried out and that the portfolio of participating lenders be reviewed to determine whether lenders have been substituting private for public guarantees and if Fogape beneficiaries were truly credit constrained. We find evidence that firms also face difficulties besides credit constraints. In the 2010 World Bank Enterprise Survey, Chilean firms identify an inadequately educated workforce as their second largest constraint. Furthermore, 25% of small and 22% of medium-sized firms identify this very constraint as their main obstacle. To address productivity concerns as well as competitiveness issues facing SME’s, we propose more complementarity between Fogape and other pro-SME institutions and public programs.

Read the full paper or view slides below:

[slideshare id=37414290&doc=fogape-evaluation-140728034549-phpapp02]