Lecture summary by Tuomas Kari ’16 (Master’s in International Trade, Finance, and Development)

Lecture summary by Tuomas Kari ’16 (Master’s in International Trade, Finance, and Development)

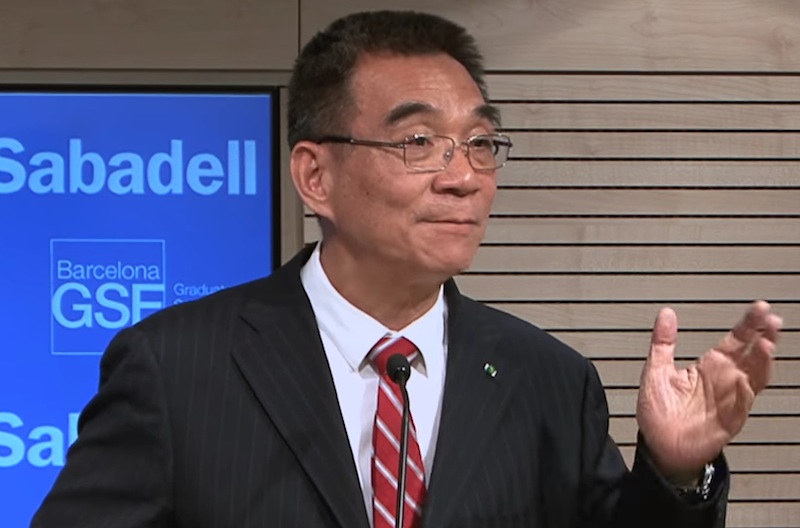

The former Chief Economist of the World Bank and member of Barcelona GSE Scientific Council Justin Yifu Lin visited Barcelona GSE on May 2nd to give a special talk to the Master students on a new approach to development policy, titled “New Structural Economics: The Third Wave of Development Thinking”. Professor Lin, who currently teaches at the National School of Development at the University of Beijing, outlined the history of development economics and its shortcomings. The goal of the lecture was to derive lessons for optimal policy and then expand upon the idea of new structural economics, the approach Prof. Lin himself advocates.

Structuralism and neoliberalism

Prof. Lin divided the history of development into two time periods: structuralism that was dominant from 1950 to the 1980s, and neoliberalism that has been the main viewpoint up to this day. Structuralism tended to assume that there were market failures that needed to be corrected with industrial policy, such as import substitution. The failure of these policies is well documented as the government-subsidized industries rarely survived at global markets and distorted the countries’ economies. Neoliberalist reaction emphasized deregulation to rid the economy of rent seeking and liberalization to let markets determine the allocation of resources. But this too failed in developing countries to reach steady growth. Often, liberalization led to the collapse of entire sectors, high unemployment and subsequent political unrest.

The main exception to these consensus policies throughout the last half a century have been the East Asian Tigers, Hong Kong, Singapore, South Korea and Taiwan, countries that followed a dual track of capitalist and state-directed policies and achieved unmatched growth rates. As these countries were initially too poor to afford expensive subsidies to heavy industry, they promoted production lower in the value chain, and even then only by piece-meal measures. According to Prof. Lin, this lack of better options guided the Tigers to good policies by accident.

Economic growth as a result of structural transformation

New structural economics is an attempt to study the determinants of economic structure and its evolution using neoclassical methods. Prof. Lin starts from the hypothesis that economic structure is endogenous to the country’s endowments and optimal policy guides the economy to activities where it enjoys comparative advantage. If a country attempts to transform its economy to activities other than those that utilize its endowments, this will only result in distortions, breaking down of market mechanisms and rent seeking. Optimal policy must start from the development of endowments (capital stock, human capital etc.) and only after try to deal with the production structure. As economic growth is ultimately a result of structural transformation, Prof. Lin argued that governments must engage in first building up the necessary endowments and then using industrial policy to help firms enter into business.

The preconditions for economic growth are having a functioning market economy efficiently allocate resources across sectors and firms, and a facilitating state that provides transitional support for firms entering and exiting the market and liberalizing the economy gradually using discretion. Lin claimed would lead to competitiveness, openness to trade, and strong fiscal and external accounts, which allow the economy to avoid crises and engage in countercyclical policies. Another benefit would be high returns to investment that provide incentives to save.

Room for more economic research

Prof. Lin promoted the setting up of Special Economic Zones to allow firms to do business free from distortions and also work as laboratories for the government to see what the comparative advantages of the economy are. He ended the lecture by proposing the development of theoretical models capable of explaining these dynamics as a fruitful avenue for the future economists in the audience.