By Ben Beuchel ’16, Frederik Møller Jensen ’16, and Saskia Mösle ’16, students in the International Trade, Finance, and Development master’s program

Why are so many Catalans advocating independence? What would be the economic consequences of a potential separation from Spain? To find answers, BGSE students from the Master’s Program International Trade, Finance, and Development organized a talk on the economic effects of Catalan independence with Prof. Jaume Ventura. Prof. Ventura is a senior researcher at the Centre de Recerca en Economia Internacional (CREI), research professor at Barcelona GSE and member of the Wilson Initiative, a pro-Catalan-independence association of academics in the fields of economics and political science.

What is the optimal size of a state?

From a theoretical viewpoint, the ‘right’ size of a state is determined by a trade-off between two opposing forces. On the one hand, economies of scale and the border effect (i.e. political borders hamper trade) create a force towards larger countries. Such benefits are especially pronounced in areas such as economic markets and defense. On the other hand, heterogeneity of people’s preferences with respect to culture, the legal system or welfare, embodies a force for smaller countries. According to Prof. Ventura, these two forces have shaped the size and structure of the state in two waves throughout the history of globalization.

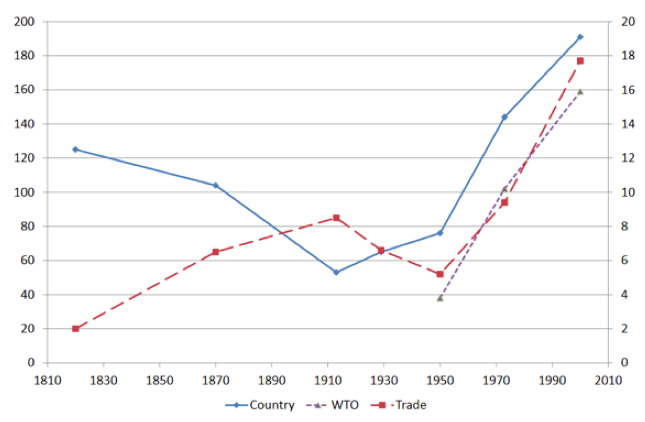

In the first wave, spanning from the Congress of Vienna to the beginning of the First World War, the number of countries more than halved, implying that states, on average, became larger. Political and economic integration proceeded hand in hand, and larger markets were created by sacrificing heterogeneity of preferences. After the Second World War, the second wave of globalization began. International trade reached higher levels and the number of countries multiplied to over 190. At the same time, international collaboration in the form of international organizations, such as the World Trade Organization, emerged. While this new era was characterized by political fragmentation regarding the nation state, larger markets were created through international cooperation and sacrificing economies of scope.

The creation of supra-national organizations enabled countries to exploit economies of scale irrespective of their size. As supra-national entities took over functions such as defense, which had previously mandated a larger state, even small states were able to thrive. At the same time, competencies such as culture, law and order and the welfare state remained on national agendas, as cultural globalization proceeds more slowly than economic globalization. All in all, it seems that the homogeneity of constituents’ preferences has become a more decisive determinant of a country’s size in the second wave of globalization.

The Catalan perspective

With this theoretical background in mind, Prof. Ventura turned to the specific case of Catalonia. First, he argued that small states in Europe, such as Norway and Switzerland, are competitive and wealthy. A potential Catalonian state with 7.5 million inhabitants would be larger than Denmark, Norway and Ireland, and only slightly smaller than Switzerland. Studies also find that the effect of size on economic growth depends on the degree of openness (Alesina, Spolaore and Wacziarg 2005). If a country is very open, size seems to have negative effects on growth. Catalonia, with a high degree of openness of 130%, could thus potentially grow faster if independent from Spain.

Next, Prof. Ventura focused on the long-run economic benefits of independence. If Catalonia became independent, this would imply giving up economies of scale arising from the union with Spain. However, these costs remain limited, in his opinion. The fixed costs of running a Catalan state have been generously estimated to be €2.793m which represents 1.4% of Catalan GDP, or €383 per Catalan citizen. Additionally, markets and defense have already been outsourced to the EU and NATO, suggesting that Catalonia would not lose out if it gave up the union with Spain (provided that it remained a member of EU and NATO). A major benefit for the Catalan economy would be the stop of fiscal transfers to the rest of Spain. Currently, taxes paid to the central government exceed public spending in Catalonia by €16.409m (8.4% of GDP). Moreover, current public capital in the region is the lowest throughout Spain. Public investment in Catalonia accounted for merely 8-9% of Spanish public spending, even though Catalonia contributes roughly 20% to the Spanish GDP.

In the short-run, there is a chance that costs might arise from retaliation by the Spanish state, and maybe others. However, Prof. Ventura estimates such costs, e.g. commercial boycotts, to be small and short-lived. He argues that retaliation would not be a sub-game perfect outcome, as most of the EU’s foreign investments and trade with Spain flows through Catalonia.

While the potential economic gains are substantial, Prof. Ventura emphasized that the heterogeneity of preferences between Catalonia and the rest of Spain remains the key reason behind Catalonia’s longing for independence. He pointed to his experience in the U.S., where the states enjoy a high degree of autonomy regarding education, justice, infrastructure, welfare and culture. In contrast, Spain’s central government dominates most aspects of public policy and previous attempts to increase Catalonia’s autonomy within Spain have failed.

While the future of Catalonia remains uncertain, Prof. Ventura advocated the right to self-determination and believes that “Catalan independence offers a unique window of opportunity to reform a bankrupt state and adapt it to modern times, both in Catalonia and Spain”.

References

- Gancia, G. A., Ponzetto, G. A., & Ventura, J. (2016). Globalization and Political Structure. NBER Working Paper No. 22046.

- Alesina, A., Spolaore, E., & Wacziarg, R. (2005). Trade, Growth and the Size of Countries. Handbook of Economic Growth, 1499-1542.