Miguel Alquezar and Gabriel Bracons (both Economics ’17 and alumni of UPF Undergraduate Program in Economics) present their Bachelor thesis research work, supervised by Barcelona GSE Affiliated Professor Luca Fornaro.

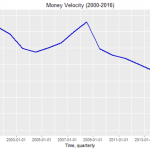

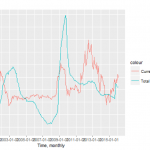

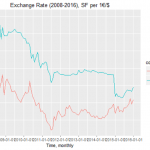

On our attempt to see to which extent theory matched reality, we checked the main economic indicators of the Swiss economy and found that real economic variables such as real GDP, unemployment rate, money velocity and loan rate were not affected by the negative interest rates policy (see charts above). But this monetary policy was not neutral either as other monetary variables such as currency in circulation (M2) and exchange rate with the Euro have been negatively impacted. Theory was also proven wrong by saving deposits which actually increased (see charts below). This adds evidence to the fact that negative interest rates have failed to achieve their expected benefits, mainly due to the increase in uncertainty generated by this “unconventional” policy. Remarkably, Swiss banks’ balance sheets show that even under negative interest rates, deposits have not sunk and lending has been steadily increasing, especially in mortgages. The only variable that seems to start to react is inflation, which is expected to be around 1% in 2017.

Conclusions

According to the theoretical implications presented above, real economy and inflation should improve as well as the whole set of variable related to them, triggering a vigorous recovery. However, real economy has not reacted to the negative interest rates as expected and the real variables remain weak by Swiss standards. Moreover, nominal variables and other indicators such as money velocity, money multiplier or loans growth have also not reacted as predicted. The fact that banks do not charge clients appears to be the main problem as they do not transfer the interest, thus accumulating more risk without further profits. This means that in the long run, the banking sector has to find a different way to offset losses that come from the negative interest rates. To solve this situation, a set of new policies has been proposed, ranging from punishing banks that do not lend money with different interest rates, to giving strong incentives to banks to lend some share of their assets in exchange of very generous conditions. Additionally, some changes to the basic model have been suggested to reduce the gap between theory and reality. Hence further work on the adoption of these new policies and changes to the model should be a fruitful line of research.

You want to learn more about this very interesting and topical issue? Consult their full research paper here: Why are negative interest rates failing?