Patrick Altmeyer (Finance student ’18) who has an interest in monetary policy, shares his work on whether misguided monetary policy can explain the European housing bubble.

Property prices surged throughout Europe in the early 2000s before collapsing during the crisis and causing tremendous welfare losses. This dissertation uses Structural Vector Autoregression (SVAR) to analyse the role of house prices within the monetary transmission mechanism in Europe over the past decades in order to understand whether lax interest rate policy had caused the bubble. Quarterly observations of inflation, output, consumption, real estate prices and mortgage variables for eight European countries were used. Sample periods vary by model specification but generally four decades.

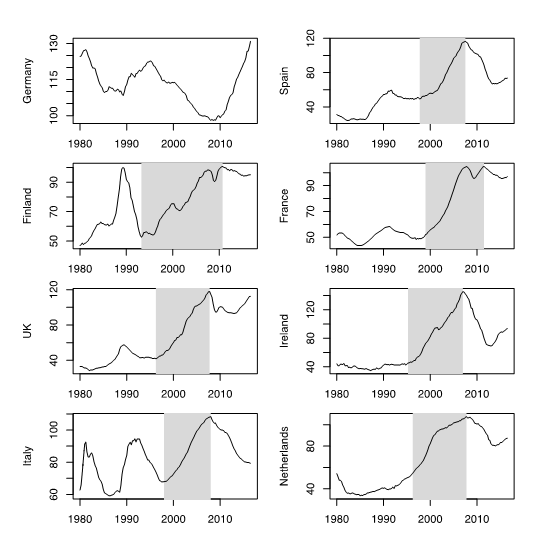

Impulse response functions for the baseline SVAR suggest that real estate prices did indeed respond positively to dovish monetary policy and thereby amplified conventional effects on consumer spending. However, the interpretation of these preliminary results is complicated by explosive house price dynamics during the early 2000s. The linear vector autoregressions fail to fully capture these non-linear elements of the time series. A statistical test developed by Homm and Breitung (2012) is therefore used to identify bubble periods in the various countries analysed. Explosive house price dynamics are found in all countries but Germany as shown in Figure 1.

Figure 1: House price trends in European countries. Shaded areas indicate bubble periods.

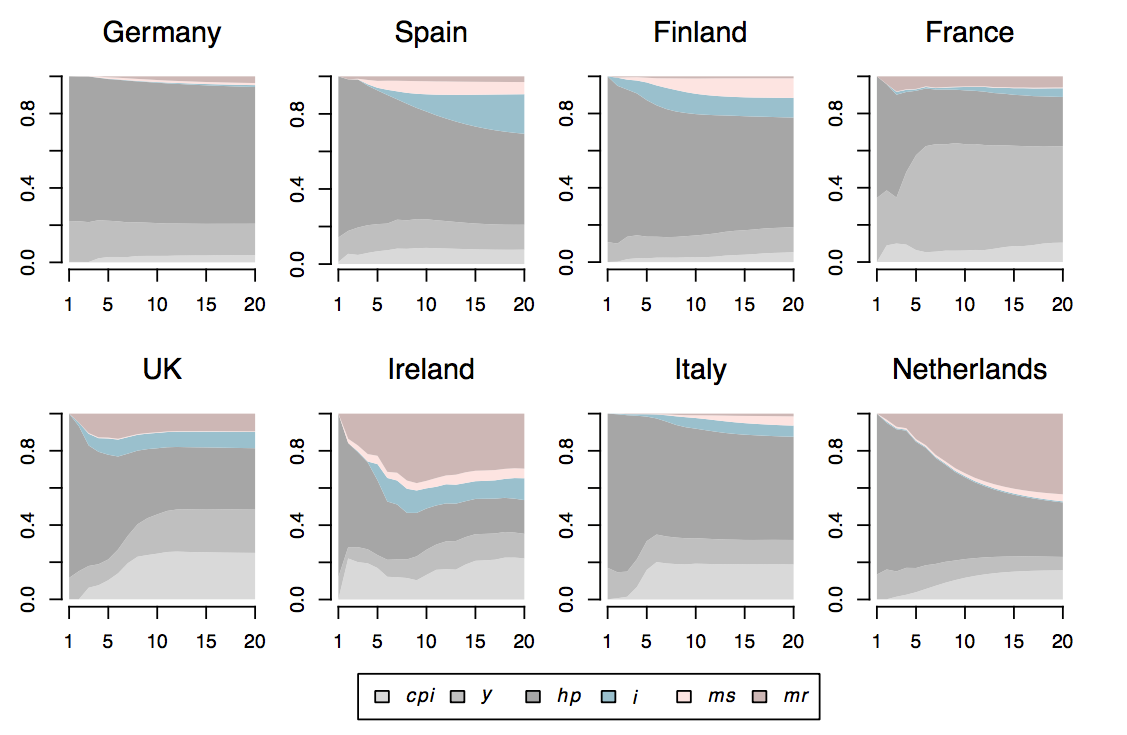

Information about house price bubbles is subsequently used to augment the baseline SVAR in various ways. Consequently, the measured effect of a decrease in interest rates on house prices remains positive, but to a lesser extent. Overall, evidence found here suggests that interest rate policy alone was not responsible for the European housing bubble. Rather, it appears that the boom could be better explained by joint effects of loose monetary policy, financial liberalisation and associated mortgage market innovations. Note, for example, that total securitisation activity measured in terms of the number of euro-denominated asset-backed securities outstanding increased six fold from 2000 until the credit bubble burst in mid 2007. Unsurprisingly, many have drawn a connection between monetary policy and securitisation commonly arguing that the latter amplified the conventional credit effects of the former. Information about mortgage rates and lending activity is used as a proxy for mortgage securitisation and added to the SVAR in the final section of the empirical part. Indeed, these variables are found to have high explanatory power with respect to house price trends in most countries as evident in Figure 2, which plots forecast error variance decompositions for each country under the preferred model specification.

Figure 2: Forecast error variance decompositions.

The paper therefore concludes that stricter interest rates more closely aligned with policy rules could not have entirely avoided the bubbles, hence this approach is not recommended for the future. Putting more focus on asset price stability and thereby departing from the policy rate’s traditional role of smoothing consumption and consumer prices would be too complicated and is therefore not advisable, either. In light of the finding that financial innovations have greatly contributed to bubbles, policy makers should continue current efforts on imposing stricter regulation through macroprudential measures.