Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2017. The project is a required component of every master program.

Authors:

Marc de la Barrera, Juraj Falath, Dorian Henricot and Jean-Alexandre Vaglio

Master’s Program:

Economics

Paper Abstract:

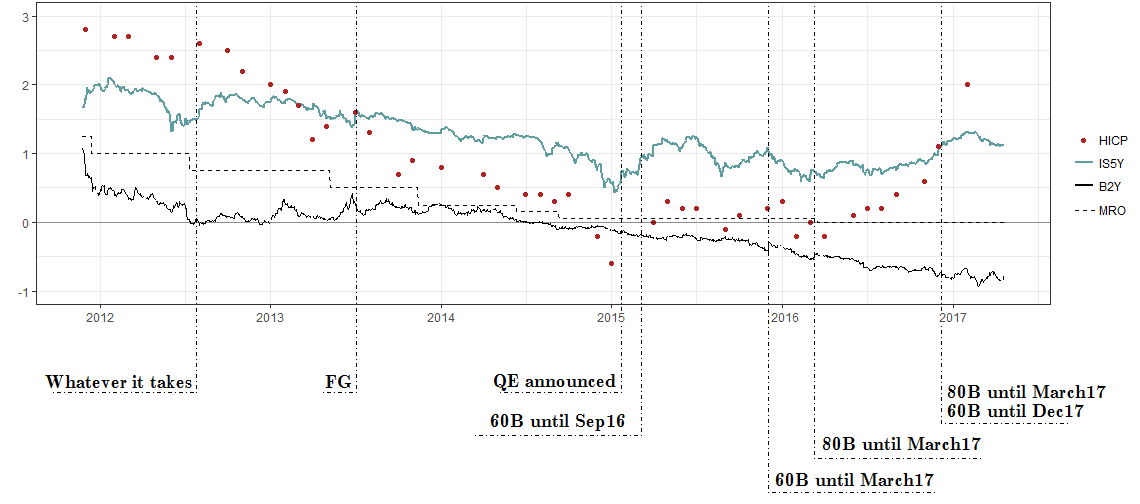

Our paper empirically investigates the impact of forward guidance announcements on inflation expectations in the Eurozone. The ECB first resorted to forward guidance on July 4, 2013 thereby expanding its array of unconventional policy instruments in the vicinity of the zero-lower bound. We use an ARCH model and identify forward guidance shocks as changes in the 2-year nominal ECB yield on specific announcement days to measure changes in daily inflation swaps of different maturities. In the process, we also separately identify the effect of quantitative easing and interest rate change announcement shocks. We find that forward guidance was successful in reviving inflation expectations in the medium to long term. Analyzing the transmission channels of forward guidance, we find evidence that both a reanchoring channel and a portfolio effect might have been at play.

Conclusions:

Forward guidance shocks have a strong impact on inflation expectations with a one point decrease in 2-year nominal ECB yields pushing inflation expectations 37bps upwards five years ahead with high significance. Normalizing, a negative shock of one standard deviation in ECB yields had a 11bps positive impact. In Campbell’s terminology (Campbell et al. (2012)), market participants’ interpretation was Odyssean. Thereby, we broadly match the results found by Hubert & Labondance (2016) for the Eurozone. Since the impact persists at all horizons, albeit with decreasing amplitude, we suggest that a reanchoring channel à la Andrade et al. (2015) explains the bulk of the transmission. ECB forward guidance announcements have thus been effective in reducing the growing gap between agents’ beliefs in future monetary policy and ECB’s targets. Our results are also consistent with a portfolio effect à la Hanson & Stein (2015). We also document that QE announcements were more effective in amplitude than forward guidance announcements, probably through a reduction in the term premium.

In contrast, studies run by Nakamura & Steinsson (2013) or Campbell et al. (2012) suggested a larger Delphic channel was at play in the US. More precisely however, they found that their results were lower than those predicted by a New Keynesian model with sticky prices. Thus, a natural extension of this paper would be to explore how our results would compare to the predictions of a New Keynesian model. Another approach would be to build a counter-factual for inflation expectations in the absence of forward guidance. In any case, given that the ECB implemented forward guidance at a time of heightened uncertainty and while long-term inflation expectations were dropping, there are reasons to believe it could have been more efficient in the Eurozone than in the US.

On the theoretical side, it is important to understand the transmission mechanisms of forward guidance within a structural model. This would allow to understand the potential gap to empirical outcomes. A number of authors have already striven to embed forward guidance within New Keynesian models and it is still an active area of research. The objective is then to derive an optimal policy function for further times of monetary policy management under the ZLB constraint.

To complete the policy recommendation, one needs to weigh out the benefits of forward guidance against its undesirable side-effects. Poloz (2014) suggested that successful forward guidance could results in increased future volatility when restoring conventional communication. Campbell et al. (2012) highlighted that central bank commitment could have a cost in terms of inflation or credibility. It would then be interesting to assess the negative externalities of forward guidance.

References:

Andrade, P., Breckenfelder, J., De Fiore, F., Karadi, P. & Tristani, O. (2015), ‘The ECB’s asset purchase programme: an early assessment’, ECB Working Paper (1956).

Campbell, J., Evans, C., Fisher, J. & Justiniano, A. (2012), ‘Macroeconomic Effects of Federal Reserve Forward Guidance’, Brookings Papers on Economic Activity 43(1), 1–80.

Hanson, S. & Stein, J. (2015), ‘Monetary policy and long-term real rates’, Journal of Financial Economics 115(3), 429–448.

Hubert, P. & Labondance, F. (2016), ‘The effect of ECB Forward Guidance on Policy Expectations’, Sciences Po publications (30).

Nakamura, E. & Steinsson, J. (2013), ‘High frequency identification of monetary non-neutrality: The information effect’, NBER Working Paper (w19260).

Poloz, S. (2014), ‘Integrating uncertainty and monetary policy-making: A practitioner’s perspective’, Bank of Canada Discussion Paper (2014-6).