Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2018. The project is a required component of every master program.

Authors:

Hazel Elizondo, Sandra Flores and Alicia de Quinto

Master’s Program:

Paper Abstract:

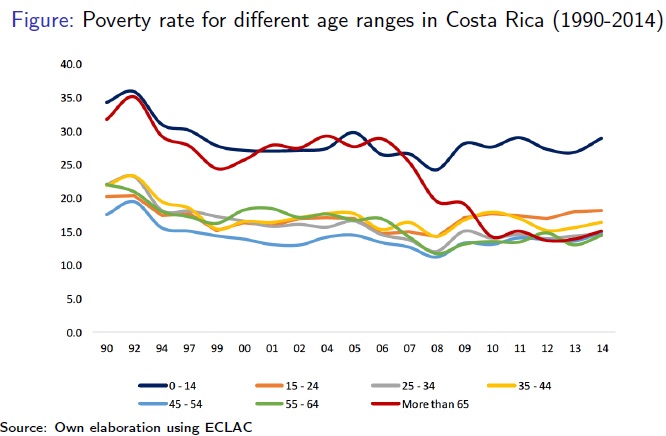

Even when only 20% of the elder population in the world receives pension coverage (Pallares-Miralles, Romero and Whitehouse, 2012) which in addition is not always adequate according to ILO, non-contributory pensions are present only in a handful of developing countries. Moreover, the elderly population is currently growing as individuals tend to live longer, what further evidences the imperative need to apply this type of programs. Costa Rica implemented a non-contributory pension policy in 1975 to ensure the livelihood of those in economic need that were not able to save provisionary funds to confront the old age risks, so that elders aged above 65 living in extreme poverty are eligible for coverage. Additionally, Costa Rica adopted a 186% increase on the pension amount in 2007 in order to mitigate poverty. This study aims to provide further empirical evidence of the indirect effects of the non-contributory pensions in Latin America, through a study case for Costa Rica that explores the impact of this pension on employment and schooling, household composition, and changes in well-being for the period from 2001 to 2009.

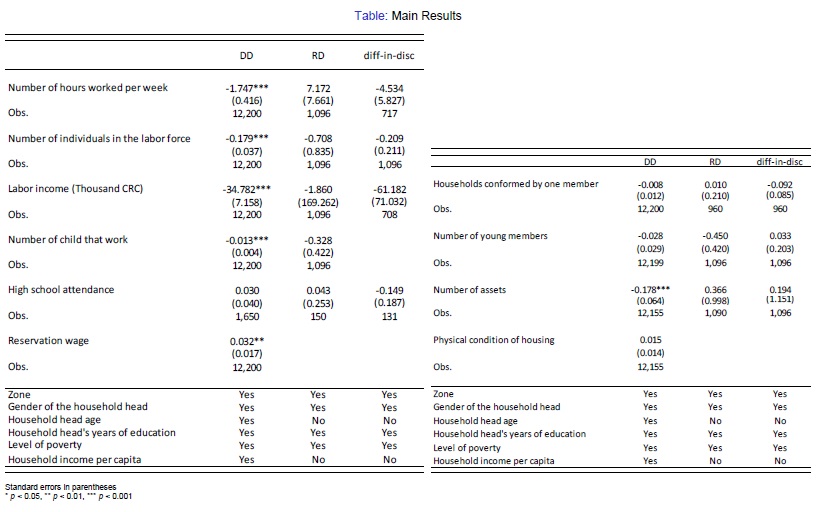

The methodology applied includes a first difference-in-differences specification (DD) as a general model, which compares the group of receivers before and after 2007 with a control group aged above 65 years old. Secondly, we exploit the discontinuity on the treatment assignment regarding the age of the oldest household member to define a Regression Discontinuity Fuzzy Design (RD). This local analysis only identifies the effects of receiving the pension, so that we move towards a third Difference in Discontinuity Design (diff-in-disc) that combines the previous models, quantifying the impacts of the pension increase as well. The RD and diff-in-disc settings include an alternative sample where the treated are households with a member between 65 and 69 years, while the counterpart is aged between 61 and 64.

Conclusions and key results:

Our results show a generally positive picture of the Costa Rican non-contributory pension, if we consider that the policy was designed to provide an allowance to elder that never contributed to the formal system, allowing them to retire at age 65. However, conditional income transfers sometimes involve unintended consequences that characterize the policy as defective.

In the case of the DD sample, where the family structures are characterized by households with senior members and households where the recipient is father or mother of the household head, the results show major spillover effects on the remaining members, especially in terms of labor- related reactions. Indeed, the estimations show that those households that benefit from the non- contributory pension reduce significantly by 0.179 the number of individuals in the labor force, compared to non-beneficiaries. Individuals in the treated households work 1.747 hours less than their counterparts and receive a labor income 61.9 USD lower than those households that do not receive the pension. Given that the Costa Rican non-contributory pension policy requires leaving the labor market as a necessary condition for receiving the grant, we might relate the reduction in labor participation to perverse incentives, as the remaining household members might take advantage of this transfer to change their time allocation preferences between work and leisure.

Nonetheless, the results obtained in the RD and diff-in-diff models rule out our preliminary interpretation. Both estimates reveal no significant reactions at the household level for any of the outcomes analyzed, what means that households do not change their employment-related decisions in the short-run, even when the recipient must leave the labor market. In this case, the households with senior members predominate over other type of family structures, hence we would have expected a significant decreasing effect for labor force participation. Probably this is because unemployment and job instability hit the most vulnerable population groups, so that individuals with uncertain job prospects see in the non-contributory pension an opportunity to receive a steady income. Moreover, we do not find evidence neither for the incentive for other young members of the family to move in with the elderly participant, nor for the recipient to move out and live on her own.

Download the full paper [pdf]

More about the Economics of Public Policy Program at the Barcelona Graduate School of Economics