Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

The Global Financial Crisis prompted central banks to adopt unconventional monetary policies such as the asset purchase programs. In our thesis, we analyze whether securities purchases carried out by the ECB have had an impact on stock prices and whether these effects vary across sectors. We decompose the central bank announcement surprises into two opposing effects, a pure monetary policy shock and an information shock. We find that the pure monetary policy shock has indeed significant effects on stock prices across all sectors, suggesting that controlling for the information shock is important when analyzing the effects of central bank announcements.

Conclusions

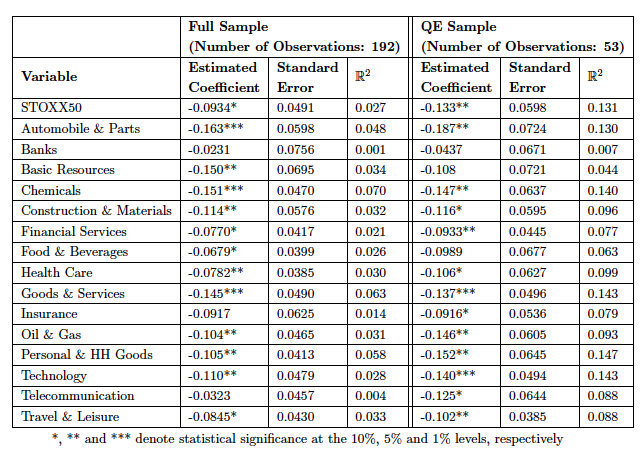

In our paper, we analyzed the effects of Quantitative Easing on stock prices in the Euro Area. Adding to previous literature, we not only analyzed the effect on the benchmark index but considered sectoral indices as well in order to allow for heterogeneous responses across different industries. Using the methodology of Altavilla et al. (2019), we first extracted the QE factor from each ECB press conference, starting from 2002. In a first exercise, we used the QE factor as a regressor to explain stock price changes on the press conference days. In line with asset pricing theory, we find negative effects of the QE shock on all sectoral stock price indices, yet, significance differs.

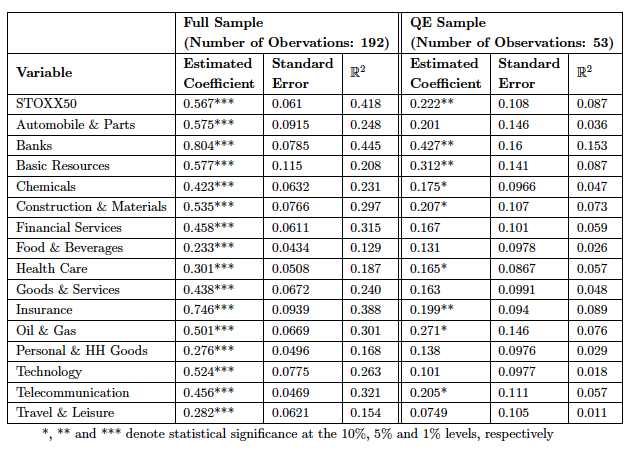

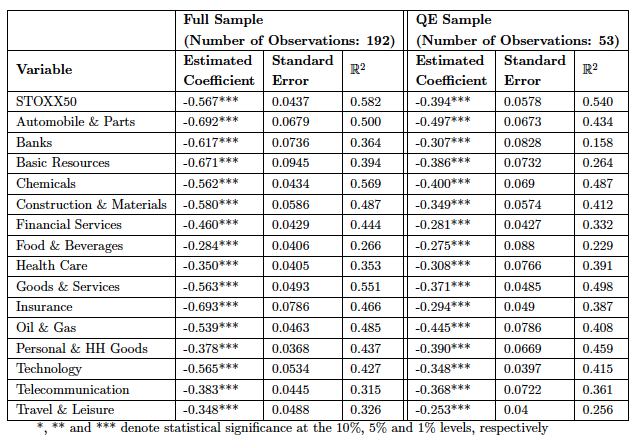

In a second step, we decomposed the shock into two components, using sign restrictions. The two shocks are referred to as information shock and pure monetary policy shock and are characterized by positive co-movement and negative co-movement of interest rates and stock prices, respectively.

We looked at these two components separately in order to assess whether insignificant results obtained in the overall regression may be due to the two components off-setting each other, a presumption which was confirmed. Furthermore, we find that the pure monetary policy shock has significant effects on stock prices across all sectors, while the information shock appears to be more important on specific sectors, which are more related to financial markets. A more in-depth analysis of the reasons for this heterogeneity could provide further insight into the effects of QE on stock prices. Moreover, repeating this exercise with a larger sample and intraday stock price data might yield improved results. Other extensions could be the analysis of specific sectors for various countries.

Connect with the authors

- Annalisa Goglione, Market Operations Trainee at ECB

- Rahel Krauskopf, Microprudential Supervision Trainee at ECB

- Aditi Rai, Global Investment Research – EM Strategy Intern at Goldman Sachs

About the BSE Master’s Program in Macroeconomic Policy and Financial Markets