I am honoured to share my new VoxEU article (with you), which I believe it’s relevant for the ongoing debate on how to strengthen the macroprudential regulatory framework for nonbanks:

Ensuring that institutional real estate investors are subject to countercyclical leverage limits would be particularly effective in smoothing the housing price and the credit cycle.

In addition, the associated ECB working paper suggests that this type of regulation would allow for rental housing prices to increase less abruptly during the boom, an issue that policymakers in several countries of the euro area have attempted to handle via price regulation (an alternative that could generate price distortions).

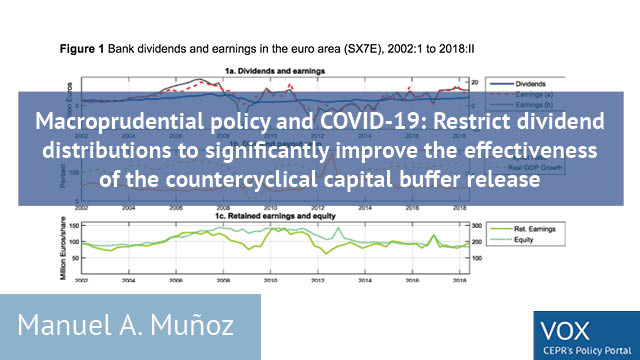

Also on VoxEU by Manuel A. Muñoz

Macroprudential policy and COVID-19: Restrict dividend distributions to significantly improve the effectiveness of the countercyclical capital buffer release (July 2020)

Connect with the author

Manuel A. Muñoz ’13 is Senior Lead Expert at the European Central Bank. He is an alum of the Barcelona GSE Master’s in Macroeconomic Policy and Financial Markets.

Are you a BSE alum with a new paper or project to share?

Learn how to submit your work to the Voice!