Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2016. The project is a required component of every master program.

Authors:

Carola Ebert, Sigurdur Olafson, and Hannah Pfarr

Master’s Program:

Macroeconomic Policy and Financial Markets

Paper Abstract:

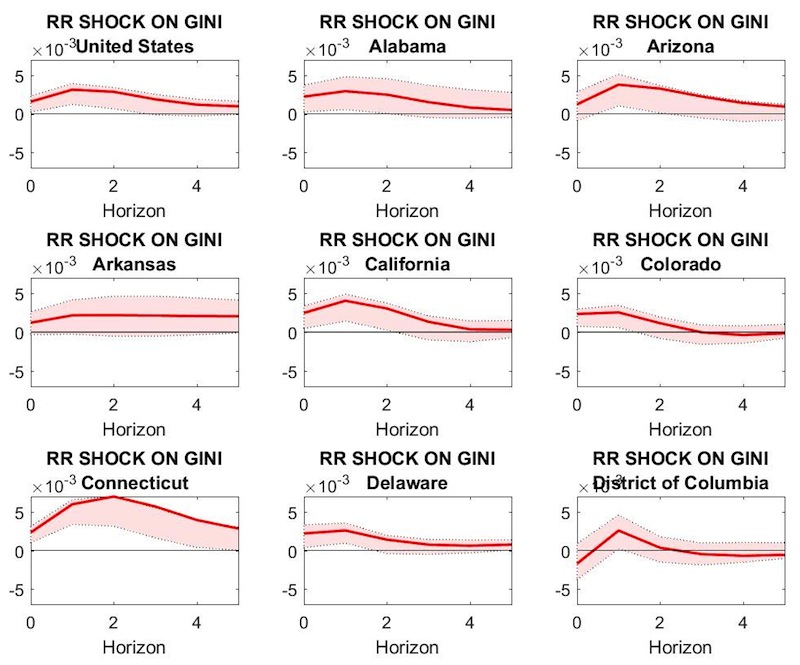

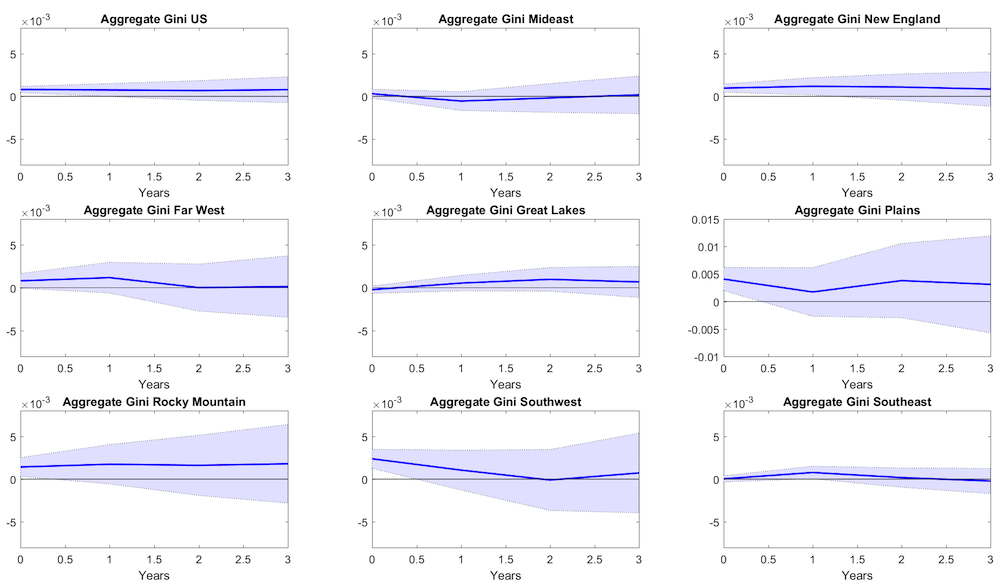

Our project focuses on the assessment of a potential relationship between monetary policy actions and economic inequality in form of the Gini index. The analysis is conducted for the United States on a country- as well as on a state-level. Lack of quality and comparability of inequality data is a major empirical challenge in the research on inequality in general. Thus, we use different methodology for the data on the Gini index to ensure the robustness of the main results on the country level. Moreover, the main contribution of this work is the analysis on a more dis-aggregated level, i.e. the state level and a regional level. The state- and region- level analysis provide a further line of investigation with respect to the relationship between monetary policy and inequality. When considering monetary policy effects on inequality on an aggregated country level, one cannot be sure whether potentially heterogeneous reactions of inequality within the country are washed away by the aggregation over states. Therefore, this paper does not only analyse the relation between monetary policy and inequality on the aggregate country level, but also on the state level. Furthermore, as a first step in the direction of investigating potential transmission channels of monetary policy into inequality, further tests with regards to the initial wealth levels across states are conducted.

Main Conclusion:

In this paper we analyzed the implication of a monetary policy shock for inequality on a country-level, regional-level and (on a) state-level (as well). The results are largely consistent across different model specifications and considering different geographic levels, implying that a contractionary monetary policy shock seems to raise inequality on impact. Although the effect is small, it is consistently positive across states and regions. Already the fact that we find that there is an effect of monetary policy on inequality is a contribution in itself.

Our benchmark model using OLS leads to the conclusion that a contractionary monetary policy shock leads to an increase of inequality. This finding holds for richer as well as poorer states. The contemporaneous impact stays positive over the considered time horizon. We have run several robustness checks using different model specification for OLS as well as a VAR approach. These checks have confirmed the earlier findings.

Outlook:

However, we have stressed that there is room for further investigation to shed light in this area.One potential way to go would be to expand the analysis by using alternative inequality measures. We conducted our analyses using the Theil and Atkinson indices obtained from Frank’s website. However, since the results obtained by using these two measures do not add anything to the analysis, we have not included them in the paper.

Furthermore, some authors stress the relevance of the top income and low income distribution when analyzing the effects of inequality. Therefore, one might think about controlling for the share of top incomes within the states to asses to what extent the reaction to monetary policy would change. We already tried capturing parts of these potential dynamics using the simple mean comparison tests for wealth dependence.

We find evidence that (seems to) suggest that monetary policy has a stronger impact on wealthy states and regions compared to poorer states and regions. Those results are obtained using simple mean-comparison tests and should be viewed as preliminary, as further research on the issue is necessary to concretely conclude whether the initial wealth-level of states and regions is relevant for the transmission mechanism from monetary policy on inequality.

After our results show that there is an effect of monetary policy on inequality, the next step in this line of research could be the investigation of the actual transmission mechanism. One could include a more elaborate analysis of the potential channels through which monetary policy affects inequality.

As a last remark, we want to point out that we were originally interested in investigating this topic for the European Monetary Union member states. This, however, is not possible due to data limitations. Firstly, across European countries there is no uniform definition and measurement of inequality. Secondly, the monetary union is fairly new and the data of a unitary monetary policy shock would be too short to conduct our analysis. Nevertheless, we do believe this is an interesting path for future research and, as pointed out in the literature review, the finding of a robust relationship between monetary policy and inequality backs this claim.