Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2018. The project is a required component of every master program.

Authors:

Master’s Program:

Macroeconomic Policy and Financial Markets

Paper Abstract:

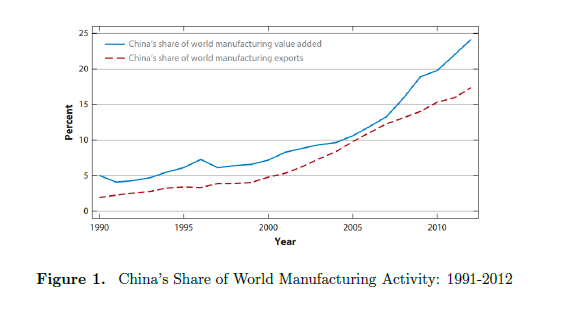

The goal of this paper is to assess quantitatively the impact that the emergence of China in the international markets during the 1990s had on the U.S. economy (i.e. the so-called China Shock). To do so, I build a model with two sectors producing two final goods, each of them using as the only input of production an intermediate good specific to each sector. Final goods are produced in a perfectly competitive environment. The intermediate goods are produced in a frictional environment with labor as the only input. First I calibrate the close economy model to match some salient stylized facts from the 1980s in the U.S. Then to assess the China Shock I introduce a new country (China) in the international scene. I proceed with two calibration strategies: (i) calibrate China such that it matches the variation in the price of imports relative to the price of exports for the U.S. between the average of the 1980s and the average of 2005-2007, (ii) Calibrate China such that variation in allocations are close to the ones observed in data, for the same window of time. I found that under calibration (i) the China Shock in the model explains 26.38% of the variation in the share of employment in the manufacturing sector, 16.28% of the variation in the share of manufacturing production and 27.40% of the variation in the share of wages of the manufacturing sector. Finally, under calibration (ii) I found that the change in relative price needed to match between 80 to 90 percent of the variation in allocations is around 3.47 times the one observed in data.

Conclusions and key results:

According to the model, the China Shock explains 26.35% of the variation in the share of manufacture employment, 16.28% of the variation in the share of manufacturing production and 27.44% of the variation in the share of wages of the manufacturing sector. The first of these results is consistent with findings in Autor et al. (2013). On the other hand, the variation in the unemployment rate of the economy is not matched, neither for the first nor the second calibration of the open economy. I also found that as a consequence of the China Shock, real wages increase when measuring them in terms of the price of the import good, and decrease when measured in terms of the price of the export good. This result is not in line with findings in Autor et al. (2013). The optimal unemployment insurance in the open economy is 6.13% of average wages higher than in the close economy because the unemployment rate of the open economy is higher than in the close economy (0.9% difference). Finally, the model generates a non-traditional source of comparative advantage, arising from differences in the relative bargaining power of workers.

Download the full paper [pdf]

More about the Macro Program at the Barcelona Graduate School of Economics