In this new publication for the Bank for International Settlements, Egemen Eren ’09 and co-authors Stefan Avdjiev and Patrick McGuire review recent events in FX swap markets in the context of the longer-term trends in the demand for dollars from institutional investors.

Key takeaways

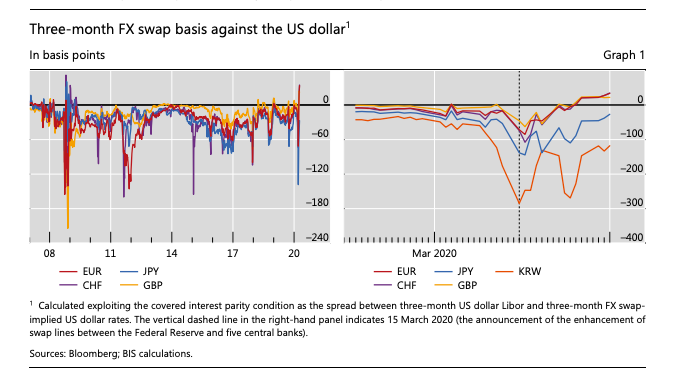

- Since the start of the Covid-19 pandemic, indicators of dollar funding costs in foreign exchange markets have risen sharply, reflecting both demand and supply factors.

- The demand for dollar funding has grown in recent years, reflecting the currency hedging needs of corporates and portfolio investors outside the United States.

- Against this backdrop, the financial turbulence of recent weeks has crimped the supply of dollar funding from financial intermediaries, sharply lifting indicators of dollar funding costs.

- These costs have narrowed after central banks deployed dollar swap lines, but broader policy challenges remain in ensuring that dollar funding markets remain resilient and that central bank liquidity is channelled beyond the banking system.

Egemen Eren ’09 is an Economist at the Bank for International Settlements. He holds a PhD in Economics from the University of Zurich and is an alum of the Barcelona GSE Master’s in Economics.