Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Paper abstract

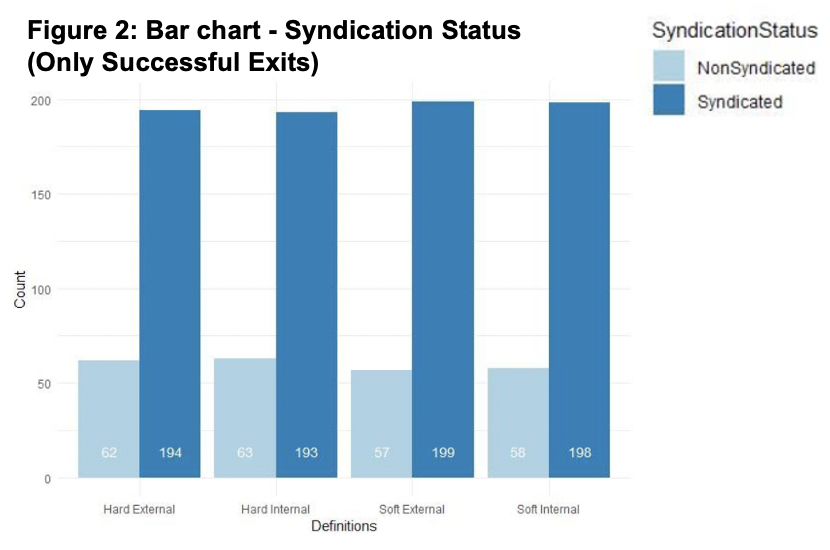

In venture capital, two or more venture capitalists (VC) often form syndicates to participate in the same financing rounds. Historically, syndicated investments have been found to have a positive effect on the investment performance. The paper provides insight into the effects of syndication on the likelihood of a successful exit for the venture-backed firm. It addresses the possible driving components such as the composition of the syndicates and, in particular, the internal investment funds being classed as external firms in two of the four models proposed, as well as a relaxation on the definition of investment round. One of the main conclusions is that in the analysis, using the chance of exiting and money in minus money out as success factors, syndication coefficients across all models are shown to have a higher chance of exiting. This supports the Value-add hypothesis and opposes the alternative, the Selection hypothesis, as it proposes that syndicated VC firms bring varying expertise to the project in order to increase the success factors post-investment. The paper advises to proceed with caution as the story is not consistent across the analysis.

Main conclusions

The paper aimed at looking to add to the literature of debates on reasons for syndication, such as the Valueadd vs Selection hypothesis as set out from various points of views. Uncertainty around profitability is the reason for syndication through the Selection hypothesis, however, the Value-add hypothesis suggests that VCs syndicate to add additional value to the venture post-investment. This is where the varying definitions of syndication we introduced, in order to draw inferences from the data. If the Soft definition of syndication (where syndication can occur across multiple investment rounds), was more successful, it may favour the Value-add hypothesis. However, in the initial test using “exited” as success, the Soft syndication models did not show a significant difference compared to the Hard syndication models.

Using the chance of exiting as a success factor, syndication coefficients across all models showed a higher chance of exiting. Using this as a success factor, you could argue for the Value-add and against the Selection hypothesis, as syndicated investments across all models resulted in a higher chance of exiting the investment. Including the key controls, resulted in similar conclusions to be drawn, with syndication increasing the log odds of exiting. This does support the conclusions of Brander, Amit and Antweiler (2002) that highlight that the Valueadd hypothesis dominates.

Using Money Out minus Money In as a success factor it was shown syndicated investments increased this which would be in line with the Value-add hypothesis according to Brander, Amit and Antweiler (2002), however, this could be down to successful companies being input with greater investments which are already successful.

Using exit duration as a success factor, conclusions were unable to be drawn about syndication, as the syndication coefficients were not significant. A potential reason for this, as the literature suggests, Guo, Lou and Pérez-Castrillo (2015), highlight, that the type of fund the investment is being purchased for has an impact on the duration and amount of funding, therefore impacting the returns of the VCs. They find that CVC (corporate venture capital) backed startups receive a significantly higher investment amount and stay in the market for longer before they exit (Guo, Lou and Pérez-Castrillo, 2015). The data did not allow us to analyse the type of fund, meaning the investment strategy could differ from the outset. As no control variable exists for the type of fund it is therefore assumed this does not significantly impact the outcome. Controlling for the type of fund may have shed light on this aspect of the results.