Economics alum Jagdish Tripathy ’11 has a paper forthcoming in the Journal of International Economics on “Cross-border effects of regulatory spillovers: Evidence from Mexico.”

Paper abstract

This paper studies the spillover of a macroprudential regulation in Spain to the Mexican financial system via Mexican subsidiaries of Spanish banks. The spillover caused a drop in the supply of household credit in Mexico. Municipalities with a higher exposure to Spanish subsidiaries experienced a larger contraction in household credit. These localized contractions caused a drop in macroeconomic activity in the local non-tradable sector. Estimates of the elasticity of loan demand by the non-tradable sector to changes in household credit supply range from 1.2–1.8. These results emphasize cross-border effects of regulations in the presence of global banks.

Key takeaways

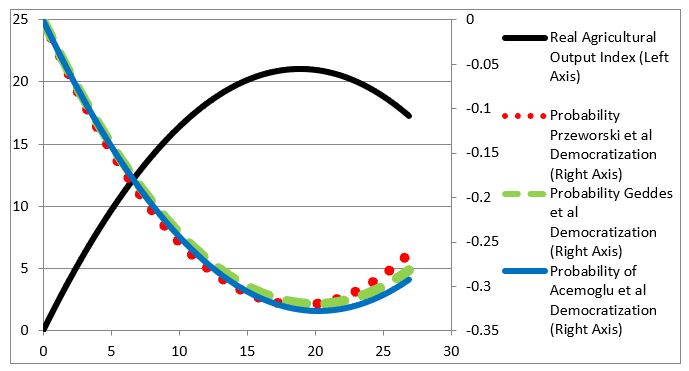

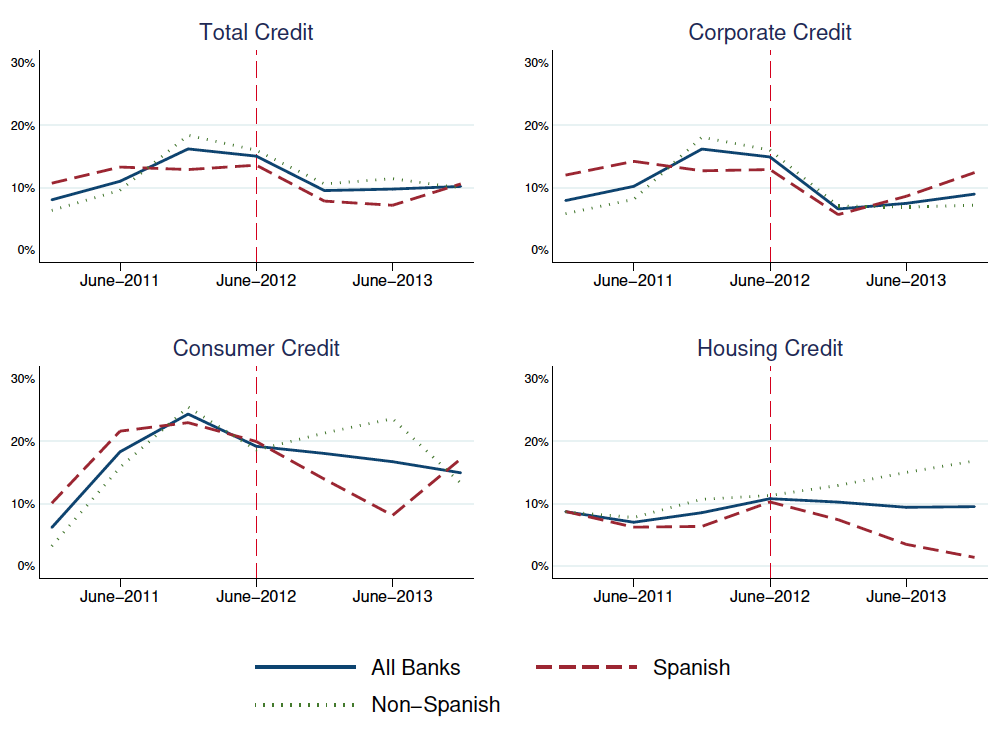

Loan-loss provisions introduced in Spain in 2012 imposed a significant burden on the balanced sheet of Spanish banks. This regulation was unrelated to the Mexican financial system or the credit conditions of Mexican households. However, Mexican subsidiaries of two large Spanish banks, BBVA and Santander, reduced lending to Mexican households in response to the regulation (Fig. 1).

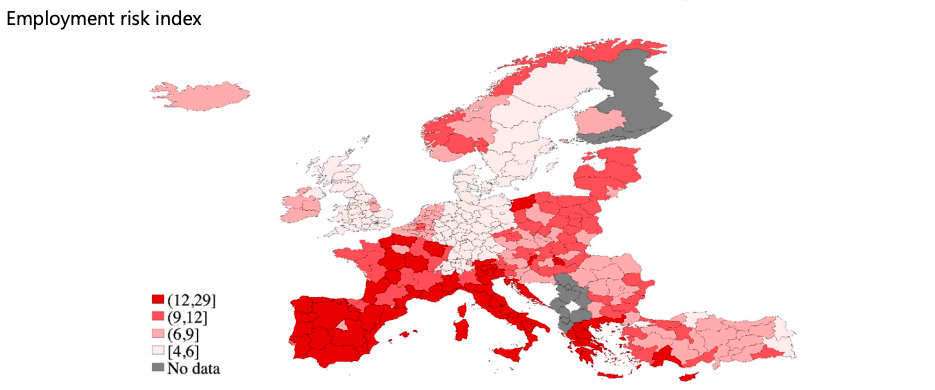

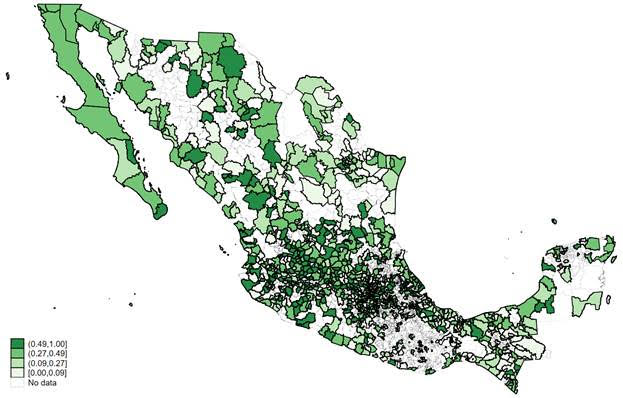

Mexican municipalities with a higher exposure to Spanish banks (Fig. 2) experienced a larger contraction in lending to households. This drop in lending to households (i.e. a drop in credit supply) was associated with a reduction in lending to the local non-tradable sector driven by a drop in local demand. This shows (1) cross-border effects of a macroprudential regulation on lending and economic activity, and (2) the macroeconomic effects of shocks in lending to households in an emerging economy.

About the author

Jagdish Tripathy ’11 is an Advisor at Bank of England. He is an alum of the Barcelona GSE Master’s in Economics and has his PhD from GPEFM (UPF and Barcelona GSE).