Does exchange rate volatility negatively affect exports? This question is of great value to policymakers, especially in small open economies, which often rely heavily on exports and often face a choice of exchange rate regimes. If volatility is found to constrain exports, that could provide an argument in favor of an exchange rate regime in which volatility may be subdued, i.e. a currency peg. If volatility does not negatively affect exports, such arguments are less valid. Another, equally important question, turns the causal relationship on its head: To what extent is exchange rate volatility caused by changes in exports?

In this article, I contribute to the discussion by studying the relationship between exchange rate volatility and goods exports in Iceland. The recent economic history of Iceland has been characterized by different exchange rate regimes and several episodes of turmoil in the currency market. Another interesting aspect of this case study is that the supply of Iceland‘s goods exports industries is by nature relatively inelastic. I focus on short-run effects using high-frequency data.

The effect of exhange rate volatility on exports has been extensively studied. Various estimation methods have been employed in the literature, but error correction models seem to be the most popular. Researchers are now increasingly addressing the issue using sector-level and firm-level data (Héricourt and Poncet, 2013; Serenis and Tsounis, 2015). Estimates of the effect of exchange rate volatility on exports range from being significantly negative (e.g. Asserry and Peel, 1991) to small (e.g. Bahmani-Oskooee, Harvey and Hegerty, 2013).

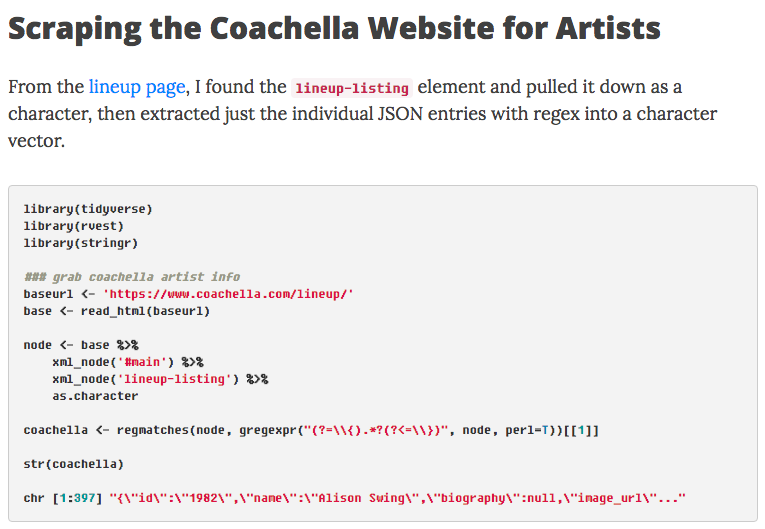

In this article, I propose a relatively straight-forward method to test for the short-run effect of exchange rate volatility on exports. Daily nominal exchange rates and monthly exports are de-trended using a Hodrick-Prescott filter. Within each month, the standard deviation of the cyclical, or residual, component of the exchange rate is calculated. This is used as a measure of exchange rate volatility, and regressed on detrended monthly exports along with control variables which pick up the annual cyclical component of exports and the short-run effect of exchange rate appreciation or depreciation.

Crucially, I achieve identification by using variation in Iceland‘s exchange rate regime as a source of exogenous variation in exhange rate volatility. Finally, I ask the other question: whether exports affect exchange rate volatility.

Exchange rate volatility in Iceland is found to be positively and significantly associated with the cyclical value of goods exports within a month in the period 1999-2015. When instrumental variables are used in order to address endogeneity, I do not find a significant short-run effect of exchange rate volatility on goods exports. This finding is not surprising given the nature of the Icelandic economy. Furthermore, I find no evidence that exports negatively affect short-run exchange rate volatility.

Background, data and hypotheses

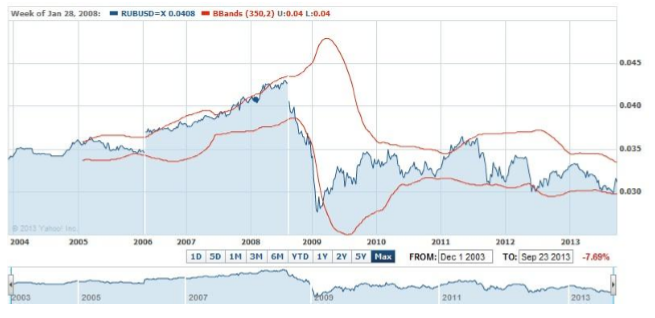

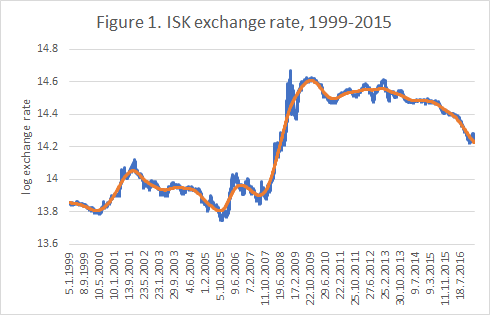

Iceland is a very small, open economy. It has an independent currency, the Icelandic króna (ISK), whose value in terms of a trade-weighted basket of foreign currencies is calculated daily by the Central Bank of Iceland (CBI). For a large part of the 20th century, the market for the ISK was distorted due to capital controls and government interventions. This changed in the 90s and early 2000s and from March 2001 to September 2008, the ISK was free floating. In November 2008, in response to a severe banking and currency crisis, the CBI instituted capital controls which significantly affected the ISK market. These restrictions were in place until 2016-2017, when they were partly lifted.

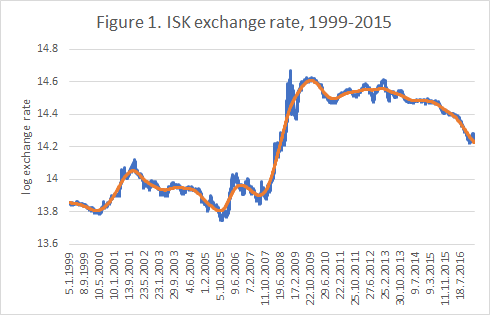

The natural logarithm of the trade-weighted index of the ISK exchange rate, retrieved from CBI and taken on a daily basis, is shown in Figure 1, along with the trend component of the exchange rate as captured by a Hodrick-Prescott filter with a smoothing parameter of 10 million. As is evident from the graph, the trend component picks up all trends that last more than a couple of months. In Figure 1, a rise in the exchange rate indicates depreciation of the ISK.

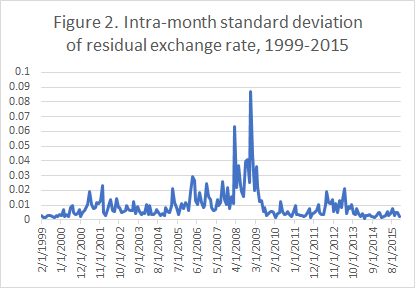

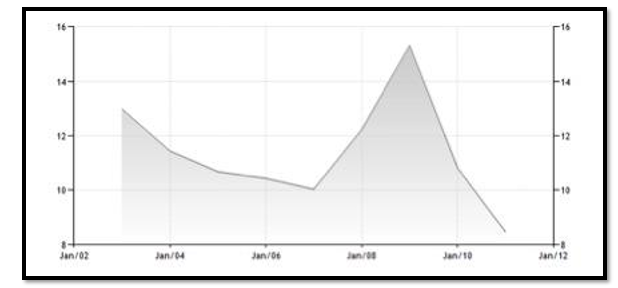

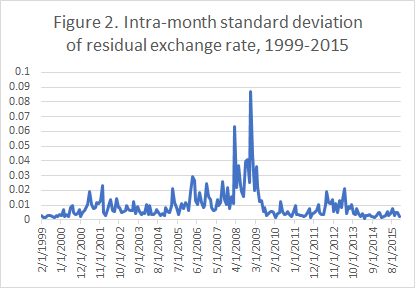

The standard deviation of the residual component is shown in Figure 2. Note the large heterogeneity in exchange rate stability over the 15 year period. In the very beginning and towards the end of the period, exchange rates were basically stable, while during some months in 2008 the standard deviation of the residual component of the exchange rate was above 0.05 on the log scale, or about 5 percentage points in terms of the exchange rate itself.

Note also that that my definition of exchange rate volatility is somewhat unorthodox. It pertains to the heterogeneity in deviations from a medium-run trend within a month. This means that during a period in which the exchange rate is appreciating or depreciating fast in the medium to long-run, a stable exchange rate in a given month is interpreted as being more volatile than if the exchange rate would follow the trend. This may raise some eyebrows, but casual observation of the data does not indicate to me that this method is critical to the measure of volatility throughout the sample period.

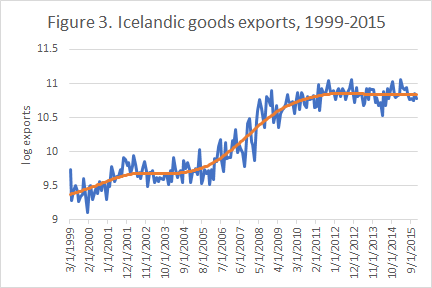

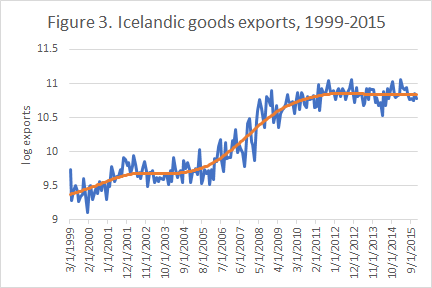

The natural logarithm of monthly goods exports from Iceland, retrieved from Statistics Iceland, is shown in figure 3 along with the trend component as captured by an HP filter with a smoothing parameter of 14.400 (the standard value in the literature for monthly data). Iceland‘s goods exports are very homogeneous. In both 1999 and 2015, around 75% of the country‘s goods exports were marine products and metals, mostly aluminum. Both industries arguably have relatively inelastic short-run supply. The marine industry is mostly constrained by natural factors such as the size of fish stocks, and for technical reasons aluminum production has to be maintained at a very stable level.

In this article, I will not provide additional empirical support for my claim that the supply of Icelandic exports are inelastic, but simply use the above anecdotal evidence to motivate the following hypothesis:

Hypothesis 1: Exchange rate volatility does not have a significant short-run effect on goods exports from Iceland.

Analysis of the data indicates that exchange rate volatility is higher during periods of currency depreciation than appreciation. This makes some intuitive sense, if one believes that due to risk aversion or an endowment effect financial markets are more volatile during stress than during an upswing. If this story is true, then it would also be true that during periods when exports rise relatively more than can be expected based on secular trends and cyclical factors, the currency market is more calm. This story can be formalized in the following hypothesis:

Hypothesis 2: In the short run, goods exports have a negative effect on exchange rate volatility in Iceland.

At first, the two results can seem contradictory. However, one has to keep in mind that both exchange rate volatility and exports are endogenously determined along with a variety of other variables. To circumvent this issue, I use different instrumental variables to test each hypothesis.

For Hypothesis 1, I use that Iceland has recently undergone periods of dramatically different exchange rate regimes, ranging from a free floating ISK with huge capital movements to a capital controls regime with little activity in the currency market. These regimes provide a source of variation in exchange rate volatility which is completely exogenous to the cyclical component of exports.

For Hypothesis 2, I use that exports are quite cyclical in nature and use monthly dummies as instruments. It is more debatable whether these dummies are valid instruments, but at the very least they do not appear to be correlated with exchange rate volatility.

Results

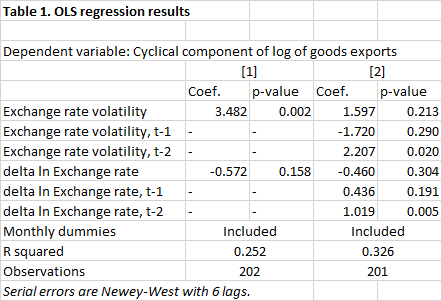

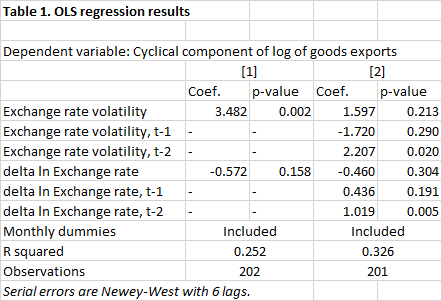

Table 1 shows the results from OLS regressions on the monthly cyclical component of the log of goods exports. Exchange rate volatility as defined above is the main independent variable of interest. I control for the effect of the overall movement in the exchange rate within the given month and in specification 2, two lagged values of these variables are included as well. Also included, but not reported, are dummies for every month of the year. The standard errors used to compute p-values correct for autocorrelation and heteroskedasticity using the Newey-West method with 6 lags.

The most significant result is that in specification 1, exchange rate volatility is positively related with exports within a given month (p=0.002). The point estimate suggests that an increase in exchange rate volatility within a month by 0.01 on the log scale (≈1% in terms of the exchange rate itself) is associated with 3,4% higher exports within a month. Beyond this, however, these regressions do not tell us a big story since we expect widespread endogeneity and reverse causality issues.

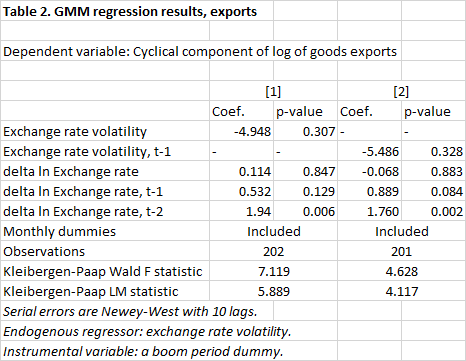

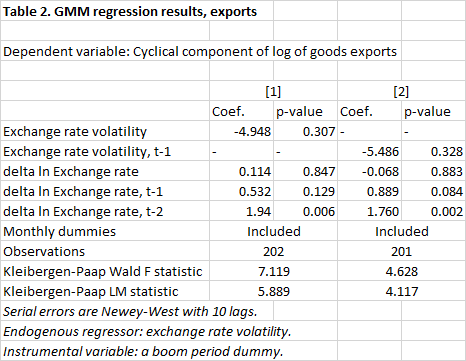

Table 2 shows the results from more interesting GMM regressions in which the log of cyclical goods exports is again the dependent variable. There is a single instrumental variable: a dummy indicating a period spanning roughly 2004-2008 during which the Icelandic economy experienced large capital flows and significant exchange rate volatility. The Kleibergen-Paap F statistics also reported allow us to reject overidentification, but the LM statistics raise some concern about weak identification in the regressions. Ignoring these concerns for the moment, we find that goods exports are not significantly affected by exchange rate volatility, neither in the current month nor in the month before.

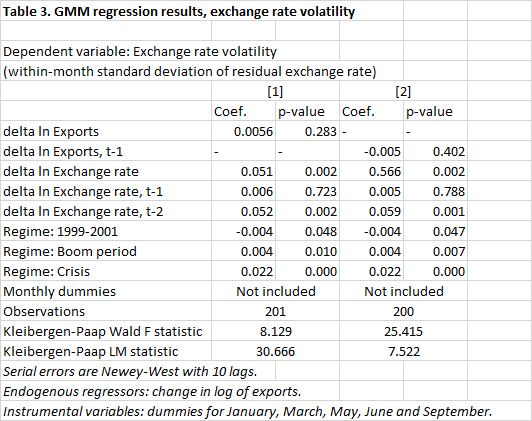

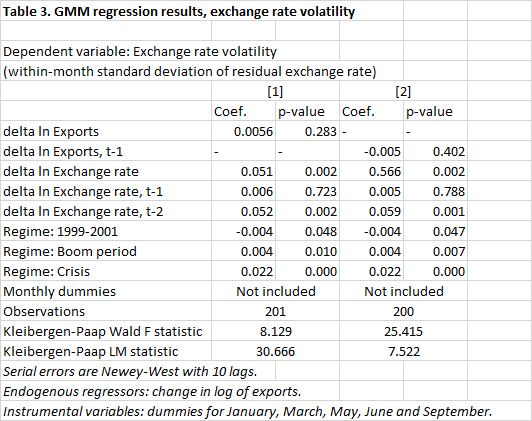

Table 3 reports the results from GMM regressions where exports are regressed on exchange rate volatility. The instrumental variables are five monthly dummies which are chosen as they are most strongly associated with cyclical trends in exports. The Kleibergen-Paap statistics raise no concern about identification. Exports do not have a significant effect on exchange rate volatility, neither in the current month nor with a one month lag.

Some robustness checks were performed. The results in Table 2 are not sensitive to the choice of currency regime used as an instrument, although regressions using other regimes exhibit more identification problems. The same goes with the results in Table 3; including all monthly dummies as instruments weakens identification but does not otherwise affect the results. When I exclude March 2008 to February 2009 from the sample – a period of extreme volatility and uncertainty in the Icelandic economy – the effect of volatility in the regressions reported in Table 2 become more statistically significant, attributing a negative effect of volatility on exports with p-values of 0.098 and 0.111, respectively. However, these regressions are weakly identified and highly sensitive to the choice of regime as instrument. The results in Table 3 are not significantly affected by excluding this period. Controlling for quarterly movements in world prices of export products also does not qualitively affect the results. I did not specifically check whether the choice of smoothing parameter in the HP filter would affect the results. Checking this seems like a logical next step.

Discussion

I have studied the very short-run relationship between exports and exchange rate volatility in Iceland. I hypothesized that due to the inelastic nature of Iceland‘s goods exports, exchange rate volatility would not significantly affect goods exports in the very short run, i.e. within 1-2 months. The above results are consistent with this hypothesis. I also hypothesized that exports would negatively affect exchange rate volatility in the short run. The analysis above does not serve to support this claim.

The analysis in this article contributes to a large discussion about the relationship between exchange rate volatility and exports. I have added yet another case study to this discussion, and demonstrated how the use of HP filters can be useful in identifying short-run fluctuations in exchange rates and exports. For data availability reasons, I only looked at Iceland‘s goods exports industries. With a surge in tourism in recent years, goods industries are a declining share in Iceland‘s total exports profile. One would expect tourism and other service industries to be more sensitive to short-run exchange rate volatility.

The study is an ongoing project and ideally, I would need to perform more robustness checks. In particular, I stress that one has to take the GMM regressions with a grain of salt, as some of them are not strongly identified and results seem to depend somewhat on the sample period and choice of instruments.

Ólafur Heiðar Helgason

Barcelona GSE, Master’s Program in Economics, 2016-2017

References

Asseery, A. & Peel, D.A. (1991). The effects of exchange rate volatility on exports: Some new estimates. Economics Letters, 37(2), 173-177.

Bahmani-Oskooee, M., Harvey, H. & Hegerty, S.W. (2013). The effects of exchange-rate volatility on commodity trade between the U.S. and Brazil. The North American Journal of Economics and Finance, 25, 70-93.

Héricourt, J. & Poncet, S. (2013). Exchange Rate Volatility, Financial Constraints, and Trade: Empirical Evidence from Chinese Firms. The World Bank Economic Review, 29(3), 550-578.

Serenis, D., & Tsounis, N. (2014). The effects of exchange rate volatility on sectoral exports evidence from Sweden, UK, and Germany. International Journal of Computational Economics and Econometrics, 5(1), 71-107.

rof. Roth began by talking about the practical influence of his own research on matching markets. As Prof. Roth explained, these are markets where prices do not succeed in bringing the demand side and supply side of the market together. For example, while in a commodity market the price determines who will produce the good (those firms that can make profits at the given price) and to whom they will sell it (those with a willingness to pay greater than the price), the same cannot be said for the placement of students in public schools or the placement of new doctors in their first hospital.

rof. Roth began by talking about the practical influence of his own research on matching markets. As Prof. Roth explained, these are markets where prices do not succeed in bringing the demand side and supply side of the market together. For example, while in a commodity market the price determines who will produce the good (those firms that can make profits at the given price) and to whom they will sell it (those with a willingness to pay greater than the price), the same cannot be said for the placement of students in public schools or the placement of new doctors in their first hospital. tribution was concerned with developments in his own field of monetary policy, including the 2008/2009 financial crisis, and he began by pointing out that many central bank employees (including the heads of central banks) graduated with PhDs in economics, and therefore economics is certain to have a practical influence on monetary policy. In this respect, Prof. Sims believes that the effects of the financial crisis would have been far more serious if Ben Bernanke (and other policymakers) had not relied on the lessons of the Great Recession of the 1930s in implementing dramatically expansionary policies in response to the crisis.

tribution was concerned with developments in his own field of monetary policy, including the 2008/2009 financial crisis, and he began by pointing out that many central bank employees (including the heads of central banks) graduated with PhDs in economics, and therefore economics is certain to have a practical influence on monetary policy. In this respect, Prof. Sims believes that the effects of the financial crisis would have been far more serious if Ben Bernanke (and other policymakers) had not relied on the lessons of the Great Recession of the 1930s in implementing dramatically expansionary policies in response to the crisis.

With the help of attendant BGSE staff, Prof. Blundell overcame a minor hiccup with his microphone to speak on the practical influence of his research in the microeconomics of public policy and tax reform, and argued that the evidence economists present can have an important impact on government policy. As an example, he referred to the

With the help of attendant BGSE staff, Prof. Blundell overcame a minor hiccup with his microphone to speak on the practical influence of his research in the microeconomics of public policy and tax reform, and argued that the evidence economists present can have an important impact on government policy. As an example, he referred to the  Prof. Jackson started his presentation with a question that would be referred to a number of times by other speakers in the contributions that followed: what is (and what should be) the role of economists in society? Prominent economists have offered different definitions of their role since the inception of the field, variously likening the profession to those of artists, ethicists, story-tellers, scientists, engineers and, most recently,

Prof. Jackson started his presentation with a question that would be referred to a number of times by other speakers in the contributions that followed: what is (and what should be) the role of economists in society? Prominent economists have offered different definitions of their role since the inception of the field, variously likening the profession to those of artists, ethicists, story-tellers, scientists, engineers and, most recently,  ghlighted two ways in which economists exercise practical influence, namely by providing evidence that influences policy, and by providing blueprints to follow when change happens too fast for appropriate evidence to be gathered.

ghlighted two ways in which economists exercise practical influence, namely by providing evidence that influences policy, and by providing blueprints to follow when change happens too fast for appropriate evidence to be gathered.