Arturo Pallardó ’15 (Master in Economics) and Christopher Gandrud (Lecturer, City University London) have put together a summary of the European multilevel bank regulatory structure.

The health of the European banking system has come back into the media spotlight. The recent fall in bank shares; the creation of the Italian “bad bank”; and Britain’s demands to shield its banks from rules governing the euro region; suggest that the debate on the design and functioning of the European banking regulatory architecture will be on the table in the following months.

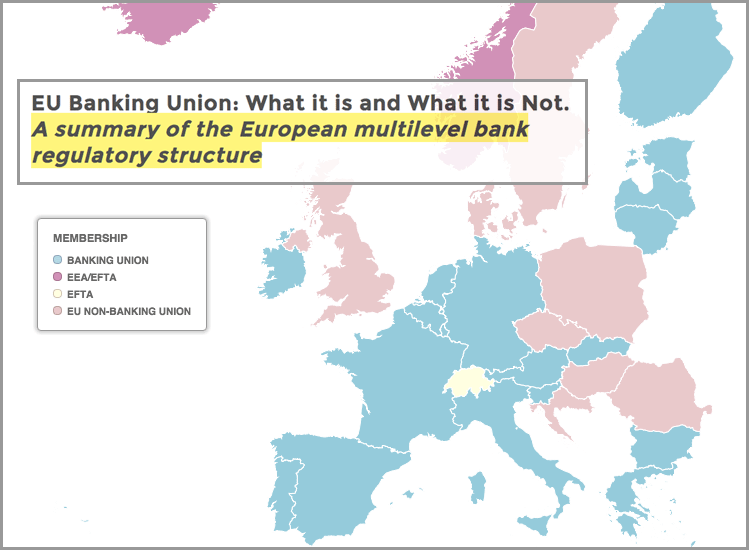

Given the complex and evolving nature of European banking regulation, there is much confusion about what has already been established and what plans are being discussed. We hope to clarify the current and proposed state of the European bank regulatory architecture. We differentiate which rules and institutions form the so-called “banking union” and which rules are part of the more general EU single market for financial services.

You can read the full summary on bankingunion.eu, a website run by Arturo that curates content and fosters debate on the European banking union’s evolution.

Follow the authors on Twitter @bankingunion_eu and @chrisgandrud