Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2016. The project is a required component of every master program.

Authors:

Andrea Fabiani, Enrico Frezzini, Federico Morescalchi, Willy Scherrieble, and Ugur Yesilbayraktar

Master’s Program:

Economics

Paper Abstract:

During periods of low productivity and stagnation, banks develop incentives to renew loans at subsidized rates to firms that would otherwise be insolvent. Proliferation of these firms, which we label as Zombies, have ramifications on the economy. Theoretical models predict that industries with a large share of zombies should experience productivity slowdowns in conjunction with lackluster employment and investment trends.

In this paper, we try to document whether this form of capital misallocation prevails between 2007-2014, by analyzing balance sheet data for more than 19,000 non-financial companies from the AMADEUS database. In fact, Italy’s productivity growth has been ailing since the early 2000’s and the volume of non-performing loans increased dramatically after the 2008 financial crisis. Moreover, prevalence of relationship banking and lack of loan loss provisioning in the country created a breeding ground for zombie lending. We identify zombies by comparing the yearly interest rate payments for the companies in our sample with those implied by a weighted average of Italian sovereign yields.

Our main contribution to the literature is to extend the seminal work by Caballero et al. (2008) to Italy, so to quantify the statistical association between zombie lending and several indicators of economic performance. Up to our knowledge, we are the first to carry a similar exercise for an economy different from Japan, whose experience in the 1990’s gave rise to the literature on zombie lending.

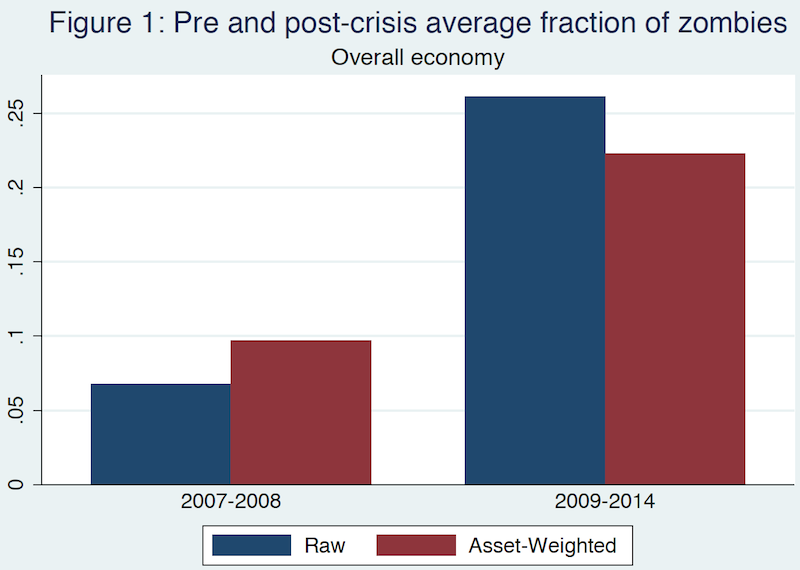

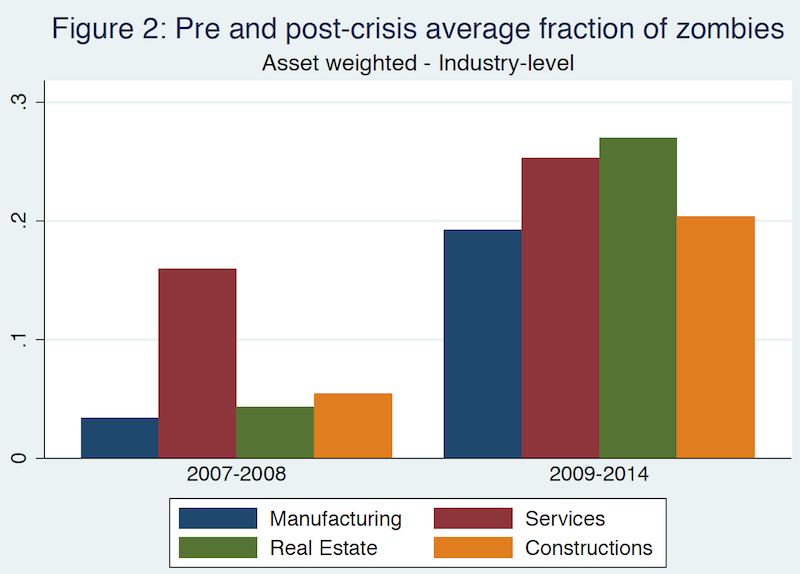

The descriptive analysis of our data reveals the increasing trend in the number of zombies in the aftermath of the financial crisis of 2008; this phenomenon appears to be widespread across different sectors of economic activity.

Furthermore, by means of OLS regressions, we show that TFP is lower and more unequally distributed in sectors with a relatively higher fraction of zombie firms, in accordance with theoretical predictions. However, the same exercise hints to a positive partial correlation between employment in healthy firms and zombie-lending, at odds with the theory.

We call for future research to explain this finding, either by enriching the underlying theoretical model so to account for realistic features of labor market or by testing the same hypothesis for other countries.