Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2016. The project is a required component of every master program.

Authors:

Sara Del Vecchio, César Ulate

Master’s Program:

Competition and Market Regulation

Paper Abstract:

Online platforms are believed to be beneficial to consumers in a number of ways. They facilitate consumers’ search and comparison, which in turn fosters competition between sellers. They drive the so called long tail effect that increases the variety of products offered, improving the consumer’s ability to find the right match for their needs. Platforms might adopt some particular measures aimed at protecting their profits, and potentially the viability of their business model. In the past few years, many online platforms have been under the scrutiny of various competition authorities regarding a particular clause they include in their contracts with sellers commonly called ’price parity clause’ or more specifically Across Platform Parity Agreement (APPA), this limits the seller’s ability to set lower prices (or better conditions) on other sale channels. At face value, price parity seems like a restriction on sellers’ pricing abilities which benefits consumers, as they can enjoy increased value service at apparently no additional cost.

We build a stylized model and we show that platforms can increase welfare and have pro-competitive effects, while price parity clauses are generally harmful for consumers surplus and welfare, nevertheless they can be good if they are indispensable for the platform viability.

Introduction:

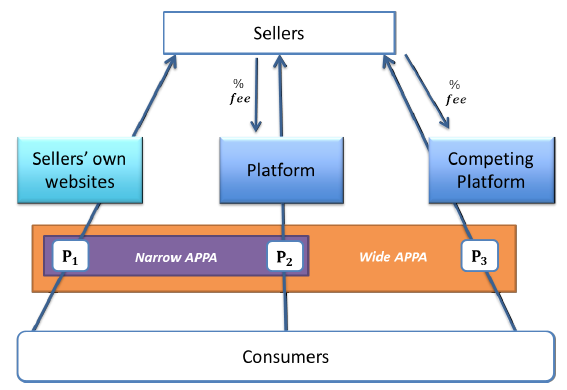

The price parity clause included in platforms’ contracts with sellers, can be categorized as narrow or wide according to the scope of the price limitation. As illustrated in the figure below a ‘narrow APPA’ (the purple rectangular in the figure) refers to a clause where the seller is restricted from charging a lower price on their direct channel. By contrast, a ’wide APPA’ (the orange rectangular in the figure) is when the seller is limited from setting a lower price not only on their own website but also on any other competing platform. This will allow the platform to make claims, such as the ’best price guarantee’ as shown in the figure.

Online platforms often argue that they need to include this constraint on seller’s price, otherwise consumers would just free ride on the platform services, and then complete the transaction on the seller’s own website which offers a lower price. At the same time, such clause in the seller-platform contract might generate anticompetitive effects, In particular, they may raise costs for sellers, which in turn are reflected into higher prices for consumers. Sellers pay a fee to intermediaries, which are insulated from competitive pressure due to the price parity clause itself.

Indeed, in the past few years many online intermediaries have been under the scrutiny of various competition authorities regarding APPAs that they were including in their contracts with sellers. There have been several cases across the world related to this clause, starting from the Apple eBook case in 2013, until the recent series of investigations in Europe regarding the online travel agent Booking.com.

In particular, the Booking.com case shows some inconsistencies in the decisions across Europe, in most of the countries (including UK, France, Italy and Sweden), Booking.com settled by agreeing to allow online travel agents, to offer lower room rates via Booking.com’s competitors, by dropping its wide APPA, restoring competition between online travel agencies. The commitments do allow Booking.com to retain its narrow APPA for prices and booking conditions, ensuring hotels offer the same rates and conditions that are provided on their own direct website. In Germany, instead, the Bundeskartellamt decided also to prohibit the narrow APPA. Nevertheless, in France they recently passed a Law (la Loi Macron) whereby they made APPAs illegal per se, with the aim of liberalising the economy and boosting growth. Furthermore, would be desirable more guidance on how to set out the most appropriate theory of harm in order to have convergence at European level in relation to these clauses.

Modeling Approach:

In this paper we build a stylised model with three different types of rational agents: (i) sellers, (ii) platforms and (iii) consumers. They all take sequential decisions in an infinitely repeated game. We include different search costs for consumers depending on the channel used to search and purchase a product. We focus only on pure strategies that lead to a particular Sub-Game Perfect Nash Equilibrium (SPNE) where all agents participate. We compare this SPNE across different scenarios: from the setting where there is a monopoly platforms, to the setting where we have competing platforms. We look at the equilibrium prices and welfare that arise in each of these scenarios with and without narrow and wide APPAs. Finally, we compare it to the counter-factual where no platform operates in the market.

Findings and Conclusion:

In terms of policy approach towards these clauses, our findings are in line with great part of the literature with respect to wide APPAs. Our model suggests that under no condition this clause can have pro-competitive effects, therefore the current European move towards a prohibition seems economically sound and sensible. With regards to narrow APPAs, instead, we believe the current call in many European countries for an outright ban could be detrimental for welfare, as it overlooks the benefits that platforms bring to the market. Indeed, we find that under some conditions these clauses despite limiting competition, do lead to efficiencies that the authorities should take into account.

We conclude that the existence of a platform is in general good, because as a first order effect it increases the number of transactions and reduces search costs for consumers. However, we find that prices will only be lower if there is effective competition between platforms. Furthermore, if the platform is not able to recover its costs though sales, then the viability of the platform may depend on the existence of the APPA. Hence, as shown the narrow APPA decreases welfare unless it is indispensable for the platform to operate.