Editor’s note: This is the first post in a series that will showcase Barcelona GSE master projects by students in the Class of 2014. The master project is a required component of every master program.

An Evaluation of the ECB’s Outright Monetary Transactions

Authors:

Madalen Castells, Alexandros Georgakopoulos, Edgar Giménez Trill, Jesse Lastunen, and Karolos Lymperakis-Pitas

Master Program:

International Trade, Finance and Development

Project Summary:

Since early 2009, the euro crisis has influenced most countries of the European Monetary Union (EMU), contributing to persistent low economic growth, high unemployment, steeply rising public financial costs and several problems with the region’s banks. As a result, a wide variety of policy measures have been adopted to address these problems. The central actors have included not only individual member states but also the European Central Bank (ECB), European Commission (EC) and International Monetary Fund (IMF).

While the success of many of the policies in recent years have been contested by different parties, the ECB’s Outright Monetary Transactions (OMT) program initiated in the summer of 2012 has been widely welcomed. Our paper attempts to understand and investigate OMT’s claimed success, motivated especially by the recent efforts to discontinue the policy. The implications with regard to the continuation of the program are potentially enormous, both economically and in terms of the social welfare of European citizens. Altogether, our motivation stems from the catastrophic consequences of the crisis, mixed success of most mid-crisis policy responses, and the uncertain destiny of OMT – perhaps one of the most crucial policy initiatives adopted in Europe after 2008.

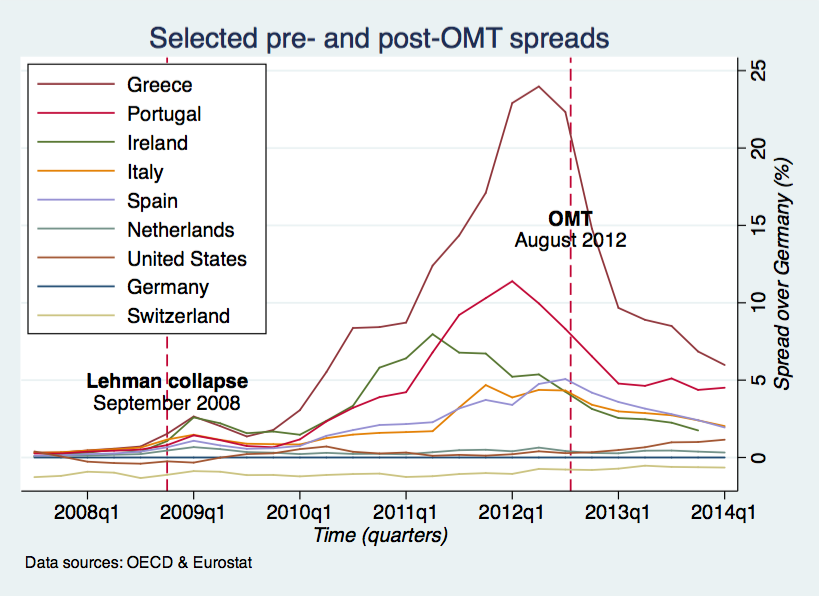

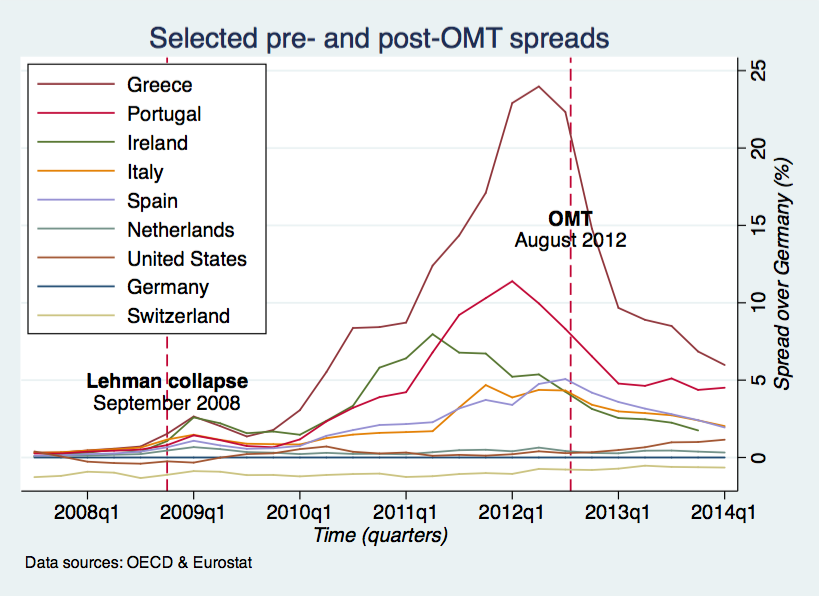

Our research questions build on the uncertain contribution of OMT to the declining bond spreads in the peripheral euro nations. We ask whether OMT was responsible for the decline in their spreads after mid-2012, why this might be the case, and whether the policy can be successful in the future. The underlying policy question is simply whether European legislators should resume OMT. Our study is based on two steps: we first examine the ”theory and practice” of the program, also conducting a compact literature survey on other research studying its effectiveness, and then turn to quantitative methods. Our quantitative analysis consists of a regression study and the application of the synthetic control method to examine OMT’s effect on declining bond spreads in the periphery. In the process, we also analyze the nature and dynamics of the post-Lehman hikes in peripheral bond spreads.

Our results suggest, firstly, that the post-Lehman takeoff in sovereign bond spreads in the periphery was largely induced by fears of sovereign default that were separated from ”normal” associations between spreads and economic fundamentals. In particular, the synthetic control countries we construct based on spread determinants in the peripheral countries do not experience any such increases in their spreads. Our regression analysis also indicates that the mid-crisis evolution of peripheral spreads differs strikingly from the values predicted based on the stable period between 2000 and 2008. Furthermore, countries outside the periphery do not suffer from the pronounced association between spreads and fundamentals.

Secondly we find that OMT was very likely to be responsible for the rapid decline in peripheral spreads after mid-2012. The synthetic control countries we construct are not significantly affected by OMT, and some actually experience slight upward trends in their spreads after the policy is announced. The method lends strong support to OMT’s role in the declines in peripheral spreads. Similarly, the regression analysis suggests that post-OMT trends in spreads approach the stable values predicted based on the pre-crisis period. In most peripheral countries, OMT also breaks up the upward trend predicted based on the period before OMT.

Our results broadly validate earlier studies by Krishnamurthy et. al (2013) and Altavilla et al. (2014) regarding OMT’s effect, and Arghyrou and Kontonikas (2011), De Grauwe and Yi (2012) and Di Cesare et al. (2012) regarding the panic-driven nature of the increased peripheral bond spreads during the crisis. Although we consider that further research regarding the suggested long-term costs of OMT is needed, we strongly believe that the benefits of the policy outweigh the hypothetical concerns, and OMT should therefore be resumed by European policymakers. In particular, OMT had the intended effect of reducing bond spreads and stabilizing monetary policy in the European Monetary Union, and there is no indication that actually implementing bond purchases through the program will be necessary.

Read the full project report or view slides below:

[slideshare id=36828144&doc=ecb-outright-monetary-transactions-slides-140710051915-phpapp02]