Editor’s note: This post is part of a series showcasing Barcelona GSE master projects by students in the Class of 2016. The project is a required component of every master program.

Authors:

Alexandros Georgakopoulos, Sampreet Singh Goraya, Viraj Rajeev Jorapur, Barrett William Owen, Jurica Zrnc

Master’s Program:

Economics

Motivation:

After the start of the Great Recession in Europe, the countries of the South (e.g. Spain) entered into a protracted stage of negative growth, amounting to an average decline in output of 1.6 perecent between 2008 and 2013, while Germany grew 0.8 percent on average in the same period. Furthermore, the decline in economic growth was accompanied by the under performance of total factor productivity growth in the South (-2.3%) relative to almost stagnant productivity growth in Germany (-0.5%). This points to some underlying factors which are not solely attributable to the demand shocks and the financial crisis.

KEY FINDINGS

Data and Measurement of Misallocation

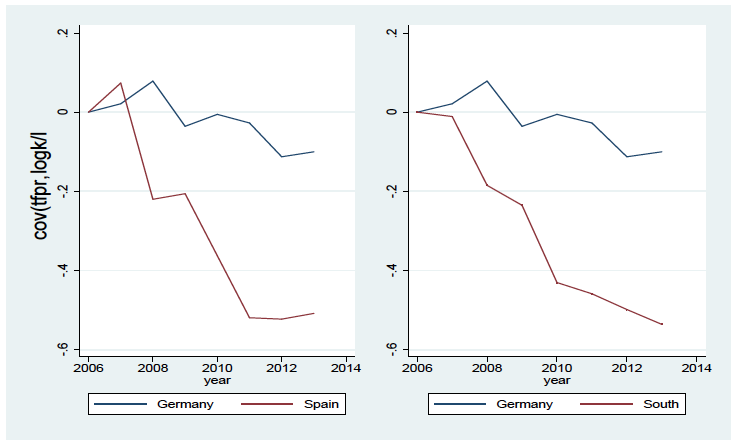

Using a rich firm-level dataset we calculate various dispersion measures of marginal revenue products of production factors. We find that marginal revenue product of capital was increasingly more dispersed in the South, but not in Germany. A large part of this increase can be explained by the weakening link between capital and productivity. This implies that capital was increasingly allocated to less productive firms.

Base year=2006, Amadeus and author’s own calculations

However, we also document increasing dispersion in marginal revenue product of labor, albeit of much smaller magnitude. This points to the possibility of common drivers behind the changes in both meassures. We argue that the common factor might be increased dispersion of TFP shocks during the recession. Similarly to Bloom et al. (2012) we interpret this as an increase in uncertainty. Furthermore, we calculate the potential gains by equalizing marginal revenue products of factors of production across firms in sectors, following Hsieh and Klenow (2007) methodology. Supporting our previous analysis, we find that gains from reallocation of resources increased considerably in the South but remained flat in Germany.

Determinants of Misallocation

In the next section, we explore different determinants of misallocation and relate it to different trends in South and Germany. First, we pool the data for six countries to explore general determinants of misallocation dynamics during the recession. Results point towards the importance of rising uncertainty during the recession, public sector influence and financial frictions in explaining the increase in misallocation during the recession. Furthermore, we find that sectors characterized with more business dynamism experienced more misallocation during the recession. This result is in accordance with Foster et al. (2014) which find that the intensity of reallocation fell rather than rose during the recent financial crisis in the US.

Secondly, we explore the differences between Germany and the South. We find that sectors with larger financial intensity were characterized by higher misallocation in the South, while not in Germany. This points to larger financial frictions in the South being important to explain the increase in misallocation. We find evidence that sectors prone to cronyism saw increased misallocation of capital in the South, while not in the North. We also find some evidence of benefits from product market reforms during recession in the South. We perform a number of robustness checks which generally support our results, although in some specifications, some parameters are not significant.