On November 11, 2020 the first day of the ECB Forum on Central Banking began with three exciting talks on how shifts in the global economy have changed the game for central banks worldwide. Among the distinguished guest speakers at the Forum was UPF, CREi, and Barcelona Graduate School of Economics Research Professor, Jordi Galí. While the ECB had him slated to speak on the “Inflation Objective, Structural Forces, and Central Bank Communication,” Professor Galí spent his presentation focusing predominantly on inflation targeting at central banks and whether it should be revised going forward.

His presentation spoke directly to an ongoing debate amongst academics and financial-market watchers, as there have been structural changes in the economy since the last update of the ECB’s policy in 2003. Structural changes are a normal function of an economy as it progresses along with society, though it has some troublesome side effects. Most concerningly, they reduce the effectiveness of policy in alleviating economic downturns by influencing the transmission mechanisms of monetary policy. This raises the challenge for policymakers in picking the best policy.

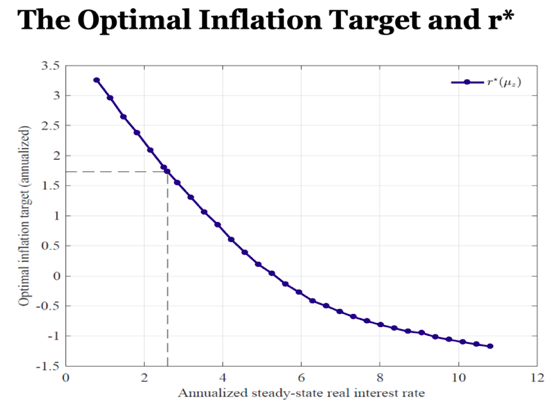

These structural changes ultimately centre around one crucial variable that is influenceable by central banks. The Steady-State Real Interest Rate, colloquially known as R*. Central banks will be constrained by this rate and hit the zero lower bound sooner if they withhold from changing the inflation target – as argued by Jordi Galí in his presentation. A lower R*, as is being observed, necessitates a higher inflation target so that monetary policy (done through a changing of the interest rate) will have less incidence of the zero lower bound and thus reducing the chance of ineffectiveness.

This is obviously an urgent issue faced by policymakers worldwide during the ongoing COVID-19 crisis from the forefront of monetary economics research, yet what Professor Galí was able to do was bring it back to the basics of economics. He emphasised how the models are built on assumptions, and if assumptions change – as the data indicate they have – then the framework for thinking about these issues need to be updated.

In this spirit, Professor Galí proposed three potential policy changes for central bankers to consider in light of the ECB strategic review: he proposed more countercyclical fiscal support; changing to average inflation targeting; or a higher inflation target from its current position of “below or at 2%”. He acknowledged the challenges and potential pitfalls of all these policies, while also speaking to their potential improvement upon the current policy.

It was great to see a Barcelona GSE professor invited to speak at such a prominent and interesting event held annually and frequented by policymakers and academics working on some of the most challenging issues in central banking. It highlights the quality of research that is being done at Barcelona GSE and the quality of the professors conducting that research being sought after by policymakers.

Maximilian Magnacca Sancho ’21 is a student in the Barcelona GSE Master’s in International Trade, Finance, and Development.

This post was edited by Ashok Manandhar ’21 (Economics).