My paper “The Micro-Origins of Business Cycles: Evidence from German Metropolitan Areas” joint with Heiko Stueber has been accepted to the Review of Economics and Statistics. Here is a summary of our work:

Cities compete to attract large firms. When Amazon announced in 2017 the opening of its second headquarters, 238 US cities signed up for it. Large firms bring jobs and can boost local productivity through spillovers. However, the downside is that they generate excessive local volatility.

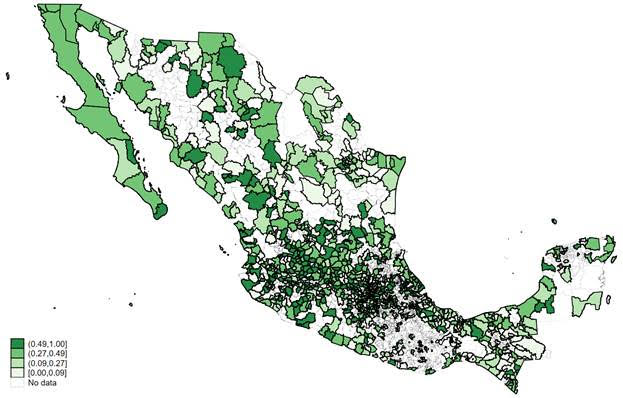

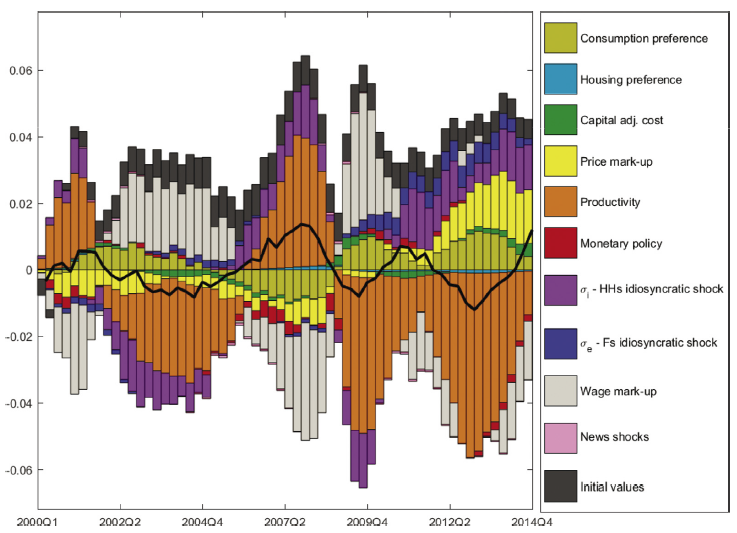

We leverage quarterly data on size of all German establishments from 1990 to 2014 to show that a buildup of concentration of economic activity in the hands of few sizable firms is systematically associated with higher volatility in local labor markets in subsequent months.

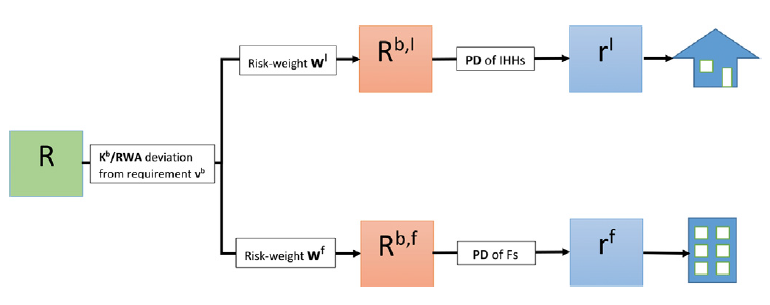

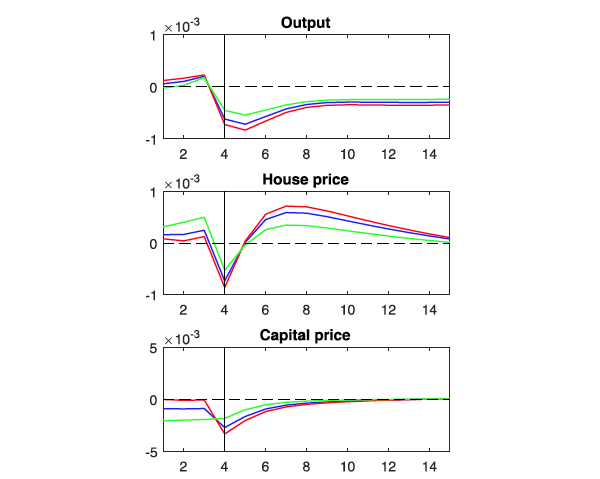

The reason is granularity. When concentration is high, shocks to large firms do not average out with shocks to smaller ones and the evolution of local employment ends up mimicking the evolution of employment in the large firm. The economy experiences “granular” business cycles.

Our paper is the first to provide solid time-series support to granular business cycles as in Carvalho and Grassi. However, we show that large firms do not seem capable to trigger both booms and busts alike. Our evidence points in favor of granularity-driven recessions only.

Finally, we calibrate the parameters governing local firm dynamics to match the local employment law of motion, because we want to see what are the causes of the disproportionate presence of large firms in big cities. We find that it’s because of higher growth opportunities in big cities.

Bottom line: the volatility externality imposed by large firms encourages short-time work schemes as opposed to layoffs and may justify using size-dependent forms of public support for crisis management, but the benefit might have to be weighed against potential moral hazard.

Connect with the author

Federica Daniele ’13 is an economist at the Bank of Italy. She holds a PhD from UPF and Barcelona GSE and is an alum of the Barcelona GSE Master’s in Economics.