This empirical exercise examines how export diversification is related with higher GDP per capita growth.

Post by Facundo Abraham ’16 and Alberto González de Aledo Pérez ’16, current master’s students in the Barcelona GSE International Trade, Finance, and Development Program.

The diversification of exports exemplifies the transition of economies towards higher levels of development with more complex economic structures. It can also facilitate risk reallocation and mitigate negative terms of trade shocks in a certain industry or geographical area. In addition, countries exposed to international competition can benefit from better ways of doing business.

This empirical exercise examines how export diversification is related with higher GDP per capita growth. For the most part it follows the dynamic panel data model proposed in Hesse (2008) for a sample of seven Asian emerging markets and developing economies. The author illustrates that these countries are considered to be a cluster characterised by both high degrees of export diversification and GDP per capita growth in the long run. The exercise updates the calculations made for this sample.

Model specification and data

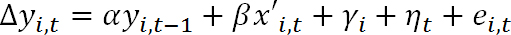

The augmented version of the Solow growth model provides the necessary framework.

The dependent variable denotes the natural log difference of GDP per capita adjusted for PPP, retrieved from the World Bank. The independent variables are the initial income and a vector of growth determinants. Gamma captures the time-invariant unit-specific effects and eta the time effects.

The vector of growth determinants consists of human capital, the natural log difference of population, the share of investment in total GDP and a measure of export diversification. Population and investment are taken as proxies for employment and savings, respectively. Together with human capital, these were retrieved from the Penn World Table 8.1 release.

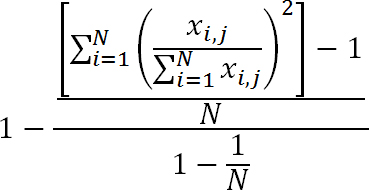

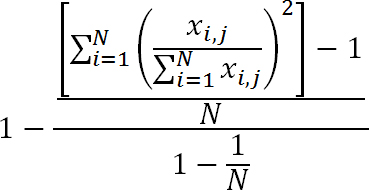

Export diversification is defined as the residual of a normalised Herfindahl-Hirschman index.

The equation exhibits reporter country i exports commodity x to partner j. The data was retrieved from the UN Comtrade database. To compute the indices, the chosen breakdown was the ninety-seven chapter disaggregation†.

The sample period used as an input to the model runs from 1996 to 2011 on an annual frequency and covers Bangladesh, China, India, Indonesia, Malaysia, the Philippines and Thailand.

The model is estimated as a system generalised method of moments (GMM) similar to Arellano and Bover (1995) and Blundell and Bond (1998). This specification uses as instruments the first-differenced equations with up to four lag levels and equations in levels with up to four lag first-differences.

Estimation and robustness check

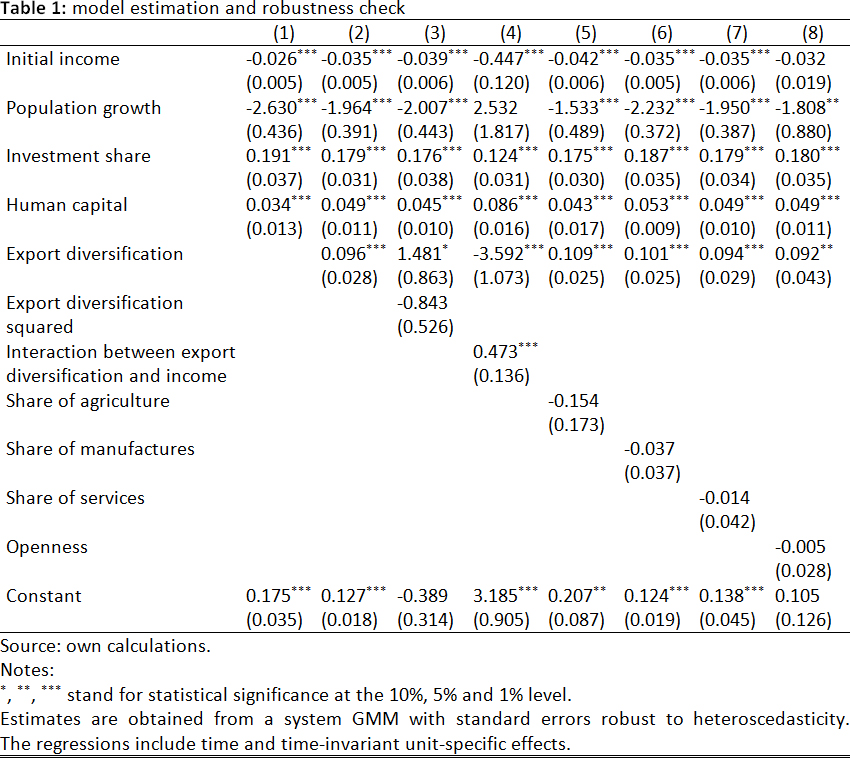

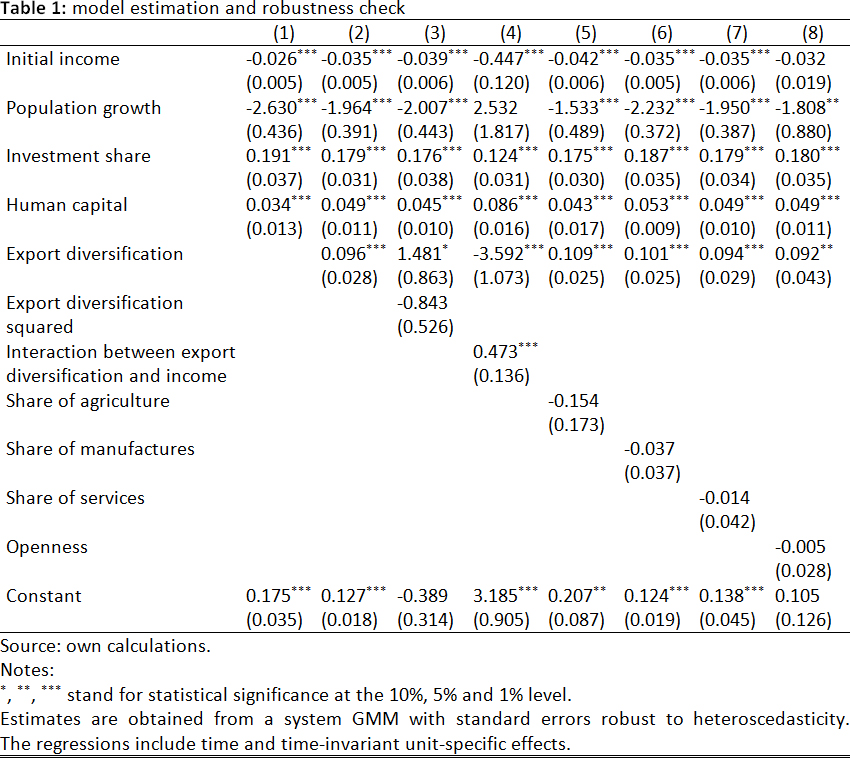

Column 1 in Table 1 presents the estimation for the augmented Solow model. The computed coefficients are significant and have the expected sign. There is evidence from column 2 that export diversification has a positive and significant effect on GDP per capita growth as has already been predicted in previous studies. Columns 5 to 8 supports the robustness of export diversification with the inclusion of different control variables. If openness is entered as it is in column 8, initial income becomes not significant. The performance on this indicator varies across countries in the sample. In the case of the Philippines and Malaysia there is a downward trend. However, in the former the initial values were remarkably high. China has also experienced a decrease in its level of openness in the aftermath of the crisis.

Column 1 in Table 1 presents the estimation for the augmented Solow model. The computed coefficients are significant and have the expected sign. There is evidence from column 2 that export diversification has a positive and significant effect on GDP per capita growth as has already been predicted in previous studies. Columns 5 to 8 supports the robustness of export diversification with the inclusion of different control variables. If openness is entered as it is in column 8, initial income becomes not significant. The performance on this indicator varies across countries in the sample. In the case of the Philippines and Malaysia there is a downward trend. However, in the former the initial values were remarkably high. China has also experienced a decrease in its level of openness in the aftermath of the crisis.

Export diversification is not a linear process. It is better depicted as an inverted U-shaped pattern. On the one side, early stages of development are characterised by a concentration in production of a handful of items or extraction of natural resources. On the other side, advanced economies also specialise their exports in a number of items. The development of complex economic structures is a harbinger of increasing competitiveness and export diversification in emerging and developing economies.

Columns 3 and 4 test for the presence of nonlinearity in the relation between export diversification and GDP per capita growth. The squared term of export diversification has a negative effect on GDP per capita growth. However, it is not significant in this specification. On the contrary, the interaction term is significant and changes sign. These regressions show some evidence of a certain degree of nonlinearity.

Concluding remarks

The exercise has examined the link between export diversification and GDP per capita growth in a cluster of economies that have a particular intense relation among these indicators. The results illustrate that income could have benefited from the diversification of exports. These findings are robust and are consistent to the sample used in Hesse (2008) and previous literature on the topic.

Future research could include further variables such as partner diversification or trade in services statistics. However, the former is limited compared to trade in commodities. In addition, in order to evaluate shocks in price and cost competitiveness, real effective exchange rates could be introduced.

References

Arellano, M. & O. Bover (1995). “Another Look at the Instrumental-Variable Estimation of Error Component Models”. Journal of Econometrics Vol. 68(1), pp. 29-52.

Blundell, R. & S. Bond (1998). “Initial Conditions and Moment Restrictions in Dynamic Panel Data Model”. Journal of Econometrics, Vol. 87, pp. 115-43.

Hesse, H. (2008). “Export Diversification and Economic Growth”. Working Paper, No. 21. Commission on Growth and Development, World Bank.

Roodman, D. (2009). “How to do xtabond2: An Introduction to Difference and System GMM in Stata”. The Stata Journal, Vol. 9, No. 1, pp. 86-136.

† Trade data is reported in the Harmonised System international standardised nomenclature for traded commodities. This convention organises items into twenty-one sections, ninety-seven chapters and subsequent headings and subheadings. For example, section 15 breaks into 12 chapters such as iron and steel (72) and articles thereof (73).

About the authors

Facundo is a current student at the International Trade, Finance and Development program. Previously he worked in consulting projects on financial regulation and supervision in Latin America. He graduated in Economics from Universidad Torcuato di Tella. Connect with Facundo on Linkedin.

Facundo is a current student at the International Trade, Finance and Development program. Previously he worked in consulting projects on financial regulation and supervision in Latin America. He graduated in Economics from Universidad Torcuato di Tella. Connect with Facundo on Linkedin.

Alberto is a current student at the International Trade, Finance and Development program. He is a former Economist in BBVA’s Economic Research Department. He holds a BSc in Economics from Universidad Carlos III de Madrid. Connect with Alberto on Linkedin or follow him on Twitter.

Alberto is a current student at the International Trade, Finance and Development program. He is a former Economist in BBVA’s Economic Research Department. He holds a BSc in Economics from Universidad Carlos III de Madrid. Connect with Alberto on Linkedin or follow him on Twitter.

Column 1 in Table 1 presents the estimation for the augmented Solow model. The computed coefficients are significant and have the expected sign. There is evidence from column 2 that export diversification has a positive and significant effect on GDP per capita growth as has already been predicted in previous studies. Columns 5 to 8 supports the robustness of export diversification with the inclusion of different control variables. If openness is entered as it is in column 8, initial income becomes not significant. The performance on this indicator varies across countries in the sample. In the case of the Philippines and Malaysia there is a downward trend. However, in the former the initial values were remarkably high. China has also experienced a decrease in its level of openness in the aftermath of the crisis.

Column 1 in Table 1 presents the estimation for the augmented Solow model. The computed coefficients are significant and have the expected sign. There is evidence from column 2 that export diversification has a positive and significant effect on GDP per capita growth as has already been predicted in previous studies. Columns 5 to 8 supports the robustness of export diversification with the inclusion of different control variables. If openness is entered as it is in column 8, initial income becomes not significant. The performance on this indicator varies across countries in the sample. In the case of the Philippines and Malaysia there is a downward trend. However, in the former the initial values were remarkably high. China has also experienced a decrease in its level of openness in the aftermath of the crisis. Facundo is a current student at the International Trade, Finance and Development program. Previously he worked in consulting projects on financial regulation and supervision in Latin America. He graduated in Economics from Universidad Torcuato di Tella. Connect with Facundo on

Facundo is a current student at the International Trade, Finance and Development program. Previously he worked in consulting projects on financial regulation and supervision in Latin America. He graduated in Economics from Universidad Torcuato di Tella. Connect with Facundo on  Alberto is a current student at the International Trade, Finance and Development program. He is a former Economist in BBVA’s Economic Research Department. He holds a BSc in Economics from Universidad Carlos III de Madrid. Connect with Alberto on

Alberto is a current student at the International Trade, Finance and Development program. He is a former Economist in BBVA’s Economic Research Department. He holds a BSc in Economics from Universidad Carlos III de Madrid. Connect with Alberto on