Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

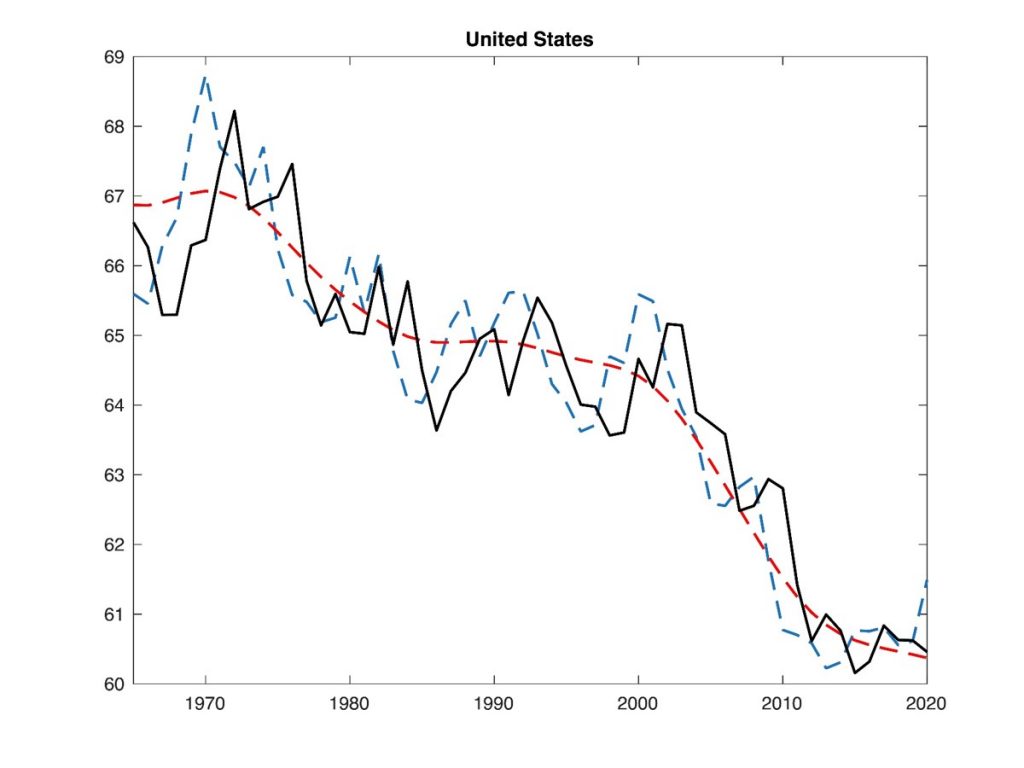

Labor share, once thought to be a constant, has experienced a secular decline in many developed economies. We investigate whether adjustment costs to intangible capital can be used to explain this trend. We develop a simple partial equilibrium model with a profit maximizing firm that produces using a three factor CES production function and faces convex adjustment costs to intangible capital. We find an intuitive expression for the steady state labor share as a function of parameters and the steady state level of investment in intangible capital.

We then run simulations to better understand the behaviour of the labor share in our model. Somewhat surprisingly, we find that adjustment costs do not affect the steady state labor share for any given elasticity of substitution. However, their presence creates a strong relationship between the labor share and the elasticity of substitution. We also find a number of short-run dynamics that are affected by the level of adjustment costs.

Conclusions

We find that our model with adjustment costs leads to a very clear relationship between the elasticity of substitution and the labor share. Therefore, one could use it to explain the secular decline in the labor share as a result of a falling elasticity of substitution in presence of convex adjustment costs to intangible capital. However, in our simple model there does not appear to be a meaningful relationship between the level of convex adjustment and the steady state labor share. Moreover, adjustment costs affect a number of interesting short-run dynamics. The level of adjustment costs changes the responsiveness of the labor share to variations in the price of inputs. Lastly in our simple model the volatility of the price process does not alter the steady state labor share, even though it does matter for short-run dynamics.

We see room for further research in the following directions. Our analysis assumes perfectly competitive markets. A model of monopolistic competition in the goods market could lead to long-run effects of the level of adjustment costs on the labor share. Karabarbounis and Neiman, 2013 showed that in such a model price decreases can explain part of the decrease in the labor share. Therefore, analysing the effect of adjustment costs in the context of monopolistic competition seems promising. Another potential avenue is the generalization of the analysis to a general equilibrium setting.

Understanding endogenous changes in wages that were set to be fixed throughout our analysis, could be important in explaining the changes in the labor share.

Connect with the authors

- Pierre Coster, Trainee at European Central Bank (ECB)

- Pia Ennuschat, PhD Track Student (UPF and Barcelona GSE)

- Raquel Lorenzo, PhD Track Student (UPF and Barcelona GSE)

- Giacomo Stazi, Data Scientist, Pricing Strategy & Analytics at HP

- Robert Wojciechowski, PhD Track Student (UPF and Barcelona GSE)