Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Introduction

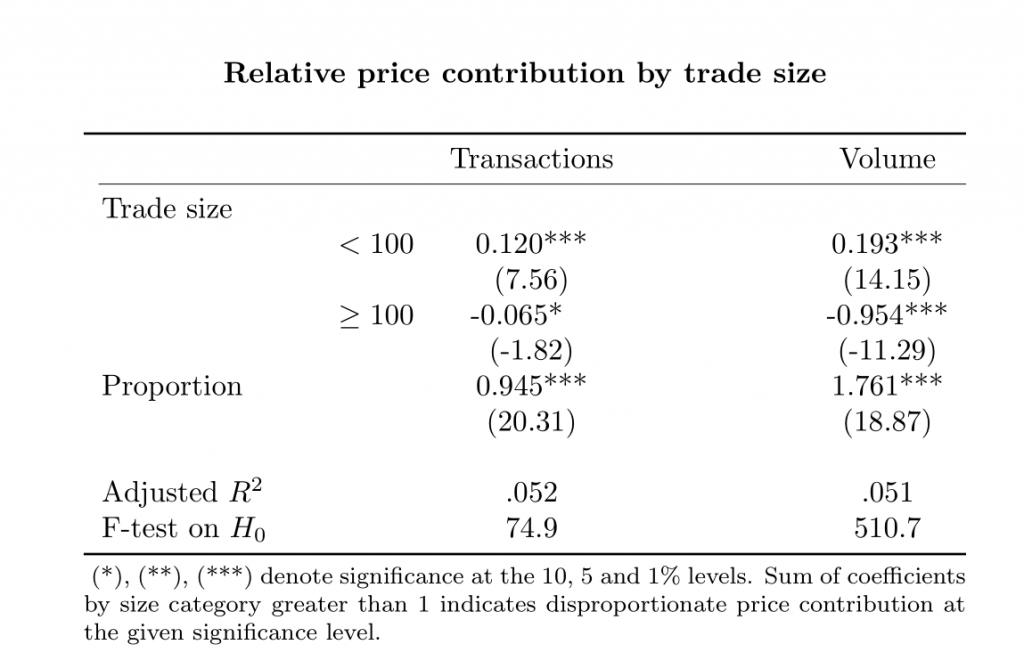

This paper builds on the stealth trading literature to investigate the relationship between several different trade characteristics and price discovery in US equity markets. Our work extends the Weighted Price Contribution (WPC) methodology, which in its simplest form posits that if all trades conveyed the same amount of information, their contribution to market price dynamics over a certain time interval should equate their share in total transactions or total volume traded in the period considered. Traditionally, the approach has been used to provide evidence that trades of smaller sizes convey a disproportionate amount of information in mature equity markets through the estimation of a parsimonious linear specification.

The methodology is flexible enough to accommodate for a first set of key extensions in our work, which focus on studying the relative price contribution from trades initiated by high-frequency traders (HFTs) and on stocks of different market capitalization categories over the daily session. Nonetheless, previous research has found that short-lived frictions make the WPC methodology ill-suited for analyzing price discovery at under-a-minute frequencies, a key timespan when HFTs are in focus. Therefore, to analyze the information content of trades of different attributes at higher frequencies we use a Fixed Effects specification to characterize trades that correctly anticipate price trends over under-a-minute windows of varying length as price informative.

Key results

At the daily level, our results underpin prior research that has found statistical evidence of smaller trades inputting a disproportionate amount of information into market prices. This result holds regardless of the type of initiating trader or market capitalization category of the stock being transacted, suggesting that the type of trader on either side on the transaction does not significantly alter the average information content over the session.

At higher frequencies, trades initiated by HFTs are found to contribute more to price discovery than trades initiated by non-HFTs only when large and mid cap stocks are being traded, consistent with prior empirical findings pointing to HFTs having a strong preference for trading on highly liquid stocks.