Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

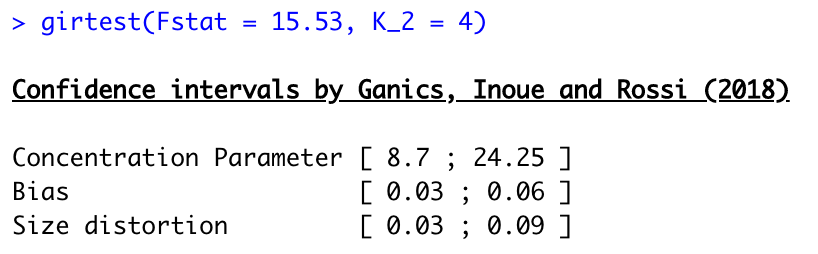

Weak identification is known to yield unreliable standard instrumental variables (IV) inference. A large literature has focused on addressing this issue by proposing methods to detect weak instruments, mainly through the first-stage F-statistic. Our paper evaluates the weak identification in two leading empirical analyses by using the novel alternative approach developed by Ganics, Inoue and Rossi (2018), who base their tests on confidence intervals for the bias of the two-stage least squares estimator, and the size distortion of the associated Wald test. We illustrate the behavior of the tests in empirical settings, and compare how the conclusions differ to those using the standard tests. Our findings suggest that, in our empirical application, the results obtained using this approach are in line with those using previous tests in the literature, confirming it to be a robust alternative. An R package to directly compute these novel tests is also presented.

Main conclusions

The contribution of our paper is mainly twofold. On the one hand, we aim at motivating the usefulness of the novel approach developed by Ganics et al. (2018) to evaluate the robustness of empirical analyses to the potential presence of weak instruments. On the other hand, we make these tests accessible to researchers via the proposed R function. The paper shows how recent tests applied to previous literature unveil new interesting information about the results obtained and hence the conclusions drawn from them. We highlight the consequences of IV estimates displaying both high sampling uncertainty and high specification uncertainty, as minor specification changes can lead to very different estimates, which is in line with current findings in the IV literature (see Yogo, 2004; Kleibergen and Mavroeidis, 2009; Mavroeidis, 2010; Mavroeidis et al., 2014; Ganics, 2017; or Barnichon and Mesters, 2019). Another remarkable issue that arises, mirroring the recent findings in Young (2019), is the importance of the baseline assumptions on the structure of the error variance to correctly interpret the estimation results.

References

- Barnichon, R. and Mesters, G. (2019), ‘Identifying modern macro equations with old shocks’, Barcelona GSE Working Paper Series (Working Paper n◦1097).

- Ganics, G. (2017), Essays in macroeconometrics, PhD thesis, Universitat Pompeu Fabra.

- Ganics, G., Inoue, A. and Rossi, B. (2018), ‘Confidence intervals for bias and size distortion in IV and local projections-IV models’, Banco de España Working Paper.

- Kleibergen, F. and Mavroeidis, S. (2009), ‘Weak instrument robust tests in gmm and the new keynesian phillips curve’, Journal of Business & Economic Statistics 27(3), 293-311.

- Mavroeidis, S. (2010), ‘Monetary policy rules and macroeconomic stability: some new evidence’, American Economic Review 100(1), 491-503.

- Mavroeidis, S., Plagborg-Møller, M. and Stock, J. H. (2014), ‘Empirical evidence on inflation expectations in the new keynesian phillips curve’, Journal of Economic Literature 52(1), 124-88.

- Yogo, M. (2004), ‘Estimating the elasticity of intertemporal substitution when instru- ments are weak’, Review of Economics and Statistics 86(3), 797-810.

- Young, A. (2019), ‘Consistency without inference: Instrumental variables in practical application’, Unpublished manuscript.