Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

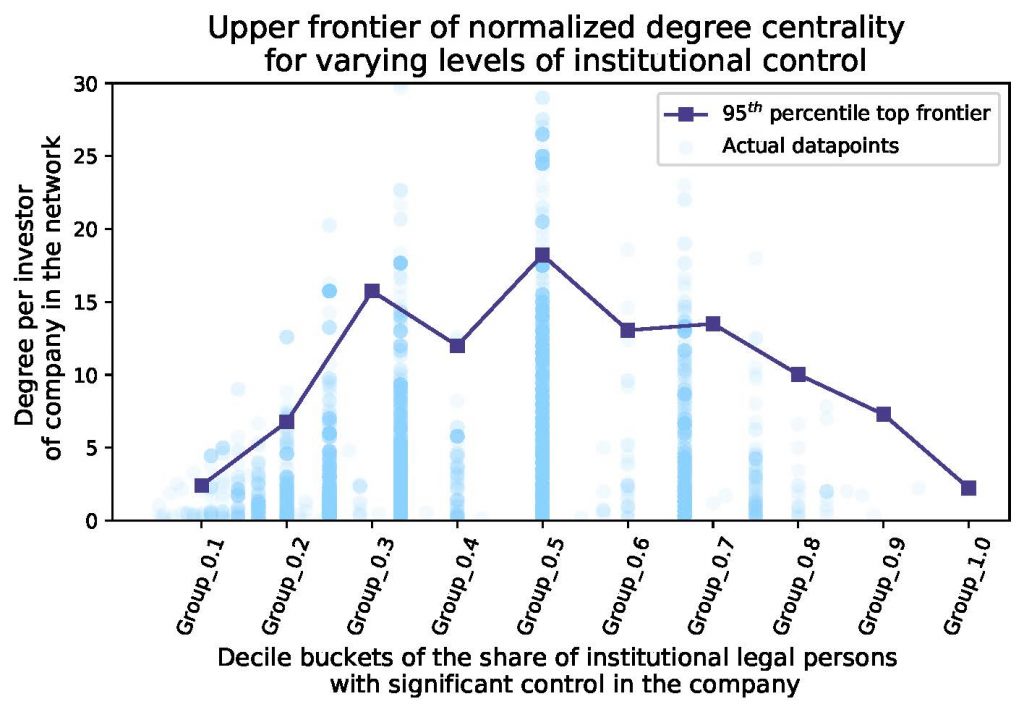

In this thesis project I analyse labour flow networks, considering both undirected and directed configurations, and company control networks in the UK. I observe that these networks exhibit characteristics that are typical of empirical networks, such as heavy-tailed degree distribution, strong, naturally emerging communities with geo-industrial clustering and high assortativity. I also document that distinguishing between the type of investors of firms can help to better understand their degree centrality in the company control network and that large institutional entities having significant and exclusive control in a firm seem to be responsible for emerging hubs in this network. I also devise a simple network formation model to study the underlying causal processes in this company control network.

Conclusion and future research

Intriguing empirical patterns and a new stylized fact are documented during the study of the company control network, since there is suggestive evidence that the types and number of investors are strongly associated with how “interconnected” a firm is in the company control network. Based on the empirical data it also seems that the largest institutional investors mainly seek opportunities where they can have significant control without sharing it with other dominant players. Thus the most “interconnected”/central firms in the company control network are the ones who can maintain this power balance in their owner structure.

The devised network formation model helps to better understand the potential underlying mechanisms for the empirically observed stylized facts about the company control network. I carry out numerical simulations, sensitivity analysis and also calibrate parameters of the model using Bayesian optimization techniques to match the empirical results. However, these results could be “fine-tuned” at different stages further, in order to have a better empirical fit. First, the network formation model could be enhanced to represent more complex agent interactions and decisions. But also, the model calibration method could be extended to include more parameters and a larger valid search space for each of those parameters.

This project could also benefit from improvements to the utilised data. For example more granular data on the geographical regions could help to understand the different parts of London more and to have a more detailed view of economic hubs in the UK. Moreover, the current data source provides a static snapshot of the ownership and control structure of firms. Panel data on this front could enhance the analysis of the company control network, numerous experiments related to temporal dynamics could be carried out, for example link prediction or testing whether investors follow some kind of “preferential attachment” rules when acquiring significant control in firms.

Connect with the author

Áron Pap, Visiting Student at The Alan Turing Institute