Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Introduction

The question of whether a currency crisis can be predicted beforehand has been discussed in the literature for decades. Economists and econometricians have been trying to develop different prediction models that can work as an Early Warning System (EWS) for a currency crisis. The significance of such systems is that they provide policy makers with a valuable tool to aid them in tackling economic issues or speculation pressure, and in taking decisions that would prevent that from turning into a crisis. This topic is especially relevant to Emerging Markets Economies due to the presence of a greater number of fluctuations in their exchange rate translating to a bigger currency crisis risk.

In this paper, we propose an Early Warning System for predicting currency crises that is based on an Artificial Neural Networks (ANN) algorithm. The performance of this EWS is then evaluated both in-sample and out-of-sample using a data set of 17 developed and developing countries over the period of 1980-2019. The performance of this Neural-Network-based EWS is then compared to two other models that are widely used in the literature. The first one is the Probit model dependent variable which is considered the standard model in predicting currency crises, and is based on Berg and Patillo, 1999. The second model under consideration is a regime switching prediction model based on that proposed by Abiad, 2006.

Artificial Neural Networks

Artificial Neural Networks (ANN-s) is a Machine Learning technique which drives its inspiration from biological nervous systems and the (human) brain structure. With recent advancement in the computing technologies, computer scientists were able to mimic the brain functionality using artificial algorithms. This has motivated researchers to use the same brain functionality to design algorithms that can solve complex and non-linear problems. As a result, ANN-s have become a source of inspiration for a large number of techniques across a vast variety of fields. The main financial areas where ANN-s are utilized include credit authorisation and screening, financial and economic forecasting, fixed income investments, and prediction of default and bankruptcy and credit card manipulations (Öztemel, 2003).

Main Contributions

1. Machine Learning Techniques:

(a) Using an Artificial Neural Network predictive model based on the multi-layered feed forward neural network (MLFN), also known as the “Back-propagation Network” which is one of the most widely used architectures in the financial series neural network literature (Aydin and Savdar 2015). To the best of our knowledge, this is the first study that used a purely neural network model in forecasting currency crises.

(b) Improving the forecast performance of the Neural Network model by allowing the model to be trained (learn) from the data of other countries in the cluster; i.e countries with similar traits and nominal exchange rate depreciation properties. The idea behind this model extension is mainly adopted from the “Transferred Learning” technique that is used in image recognition applications.

2. The Data Set: Comparing models across a large data set of 17 countries in 5 continents, and including both developing and developed economies.

3. Crisis Definition: Adding an extra step to the Early Warning System design by clustering the set of countries into 6 clusters based on their economy’s traits, and the behavior of their nominal exchange rate depreciation fluctuations. This allows for having a crisis definition that is uniquely based on each set of countries properties – we call it the ’middle-ground’ definition. Moreover, this allowed to test for the potential of improving the forecasting performance of the neural network by training the model on data sets of other countries within the same cluster. 4. Reproducible Research: Downloading and Cleaning Data has been automated, so that the results can be easily updated or extended.

Conclusions

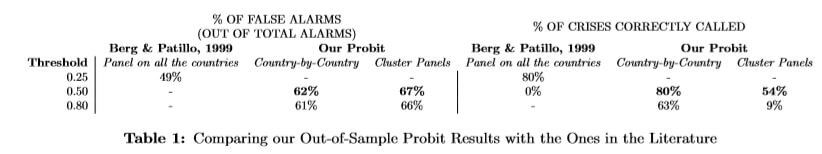

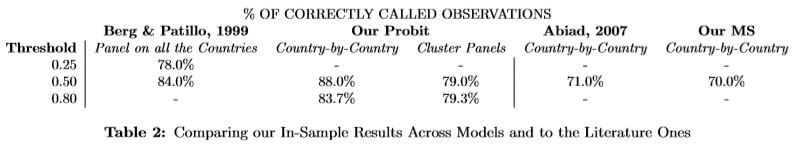

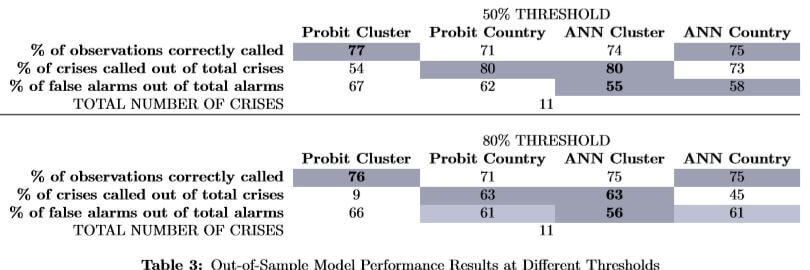

We compare between models based on two main measures. The Good Signals measure captures the percentage of currency crises predicted out of the total crises that actually occurred in the data set. The second measure used for comparing across models is the False Alarms measure. That is, the percentage of false signals that the EWS gives out of the total number of crises it predicts. In other words, that is the percentage of times when the EWS predicts a crisis that never happens.

The tables presented below show our findings and how the models perform against each other on our data set of 17 countries. We also provide the relevant findings from literature as a benchmark for our research.

The results in Table 1 show that Berg & Patillo’s clustering of all countries together generally works worse than our way of clustering data. Therefore, we can confirm that the choice of a ’middle-ground’ crisis definition has indeed helped us preserve any potential important country- or cluster-specific traits. In brief, we get comparable results to the ones found in the literature when using conventional methods, as highlighted by the table to follow.

After introducing the ANN model and its extension, we observe their Out-of-Sample models performance and obtain some of the key results to our research.

Summary of the key results

- The proposed Artificial Neural Network model crisis predictability is shown to be comparable to the standard currency crisis forecasting model across both measures of Good Signals and less False Alarms. However, the modified Neural Network model on the special clustering data set has shown superior performance to the standard forecasting model.

- The performance of the Artificial Neural Network model observed a tangible improvement when introducing our method of clustering the data. That is, data from similar countries as part of the training set of the network could indeed serve as an advantage rather than a distortion. To the contrary, using the standard Probit model with the panels of clustered data resulted in lower performance as compared to the respective country-by-country measures.

Authors: Ivana Ganeva and Rana Mohie

About the BSE Master’s Program in Macroeconomic Policy and Financial Markets