Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

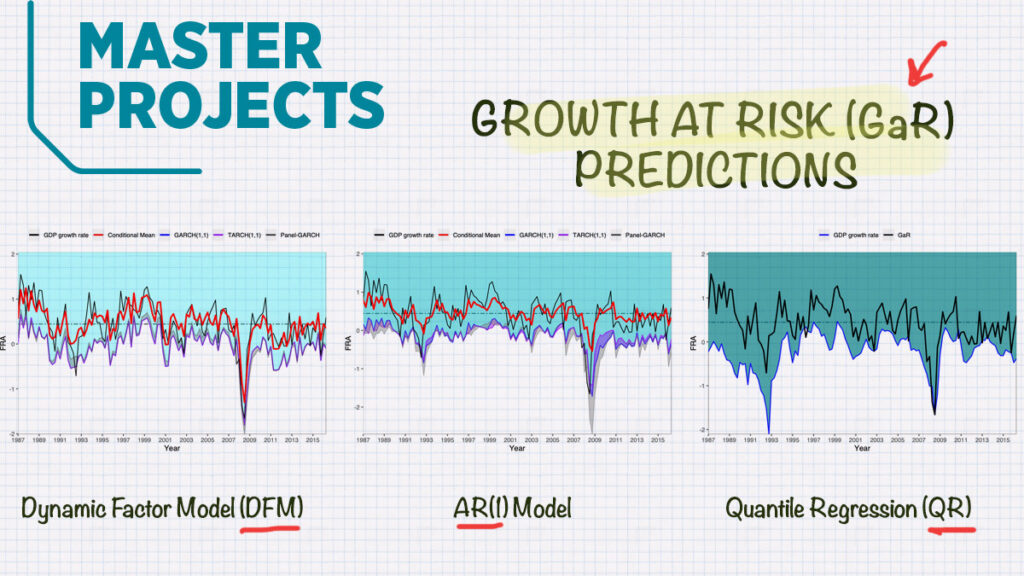

In order to analyse whether financial conditions are relevant downside risk predictors for the 5% Growth at Risk conditional quantile, we propose a Dynamic Factor- GARCH Model, comparing it to the two most relevant approaches in the literature. We conduct an out-of sample forecasting analysis on the whole sample, as well as focusing on a period of increased European integration after the 2000s. Always, including the national financial conditions index, term structure and housing prices for 17 European countries and the United States, as down side risk predictors. We find evidence of significant predicting power of financial conditions, which, if exploited correctly, becomes more relevant in times of extraordinary financial distress.

Conclusions

We propose a Dynamic Factor-GARCH model which computes the conditional distribution of the GDP growth rates non-parametrically, exploiting the dimensions of a panel of national financial conditions and compare it to the models of Adrian, Boyarchenko, and Giannone (2016 )and Brownlees and Souza (2021) out-of-sample.

Contrasting to our in-sample results, the out-of sample results exhibit a higher degree of heterogeneity across countries. While our model performs at least as good or better as the AR(1)-GARCH(1,1) specification of Brownlees and Souza (2021) in the long run, it produces unsatisfactory results for the one-step forecast horizon.

However, by focusing our out-of-sample analysis on a smaller sample around the period of the Great Recession, we not only outperform the other two models analysed, but also obtain strong indication of increased importance and predictive power of financial conditions.

We provide evidence that by correctly modelling financial conditions, they not only exhibit predictive ability for GDP downside risk, but also improve in-sample GaR predictions. Further, we show that they are relevant out-of-sample predictors in the long run. Finally, when focusing on periods of extraordinary financial distress, like the Great Recession, financial conditions become even more relevant. However, the right model needs to be applied in order to exploit that predictive power.

Connect with the authors

- Lapo Bini ’21

- Daniel Mueck ’21