Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

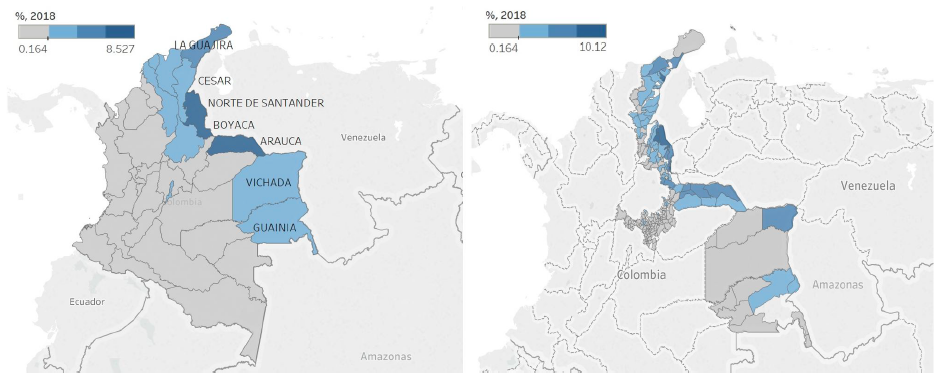

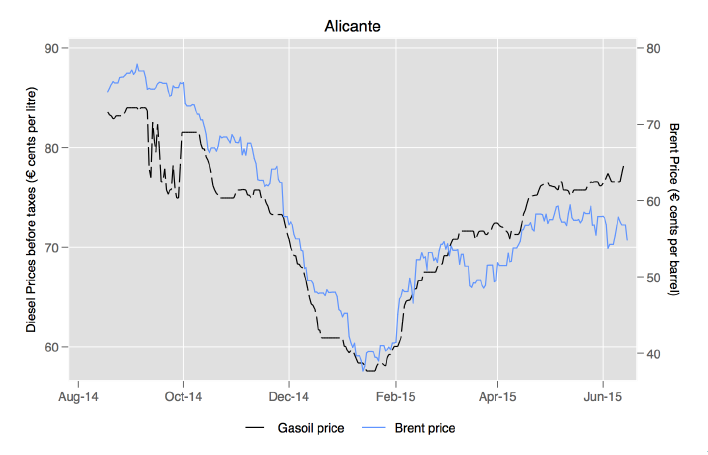

Asymmetric pricing in the retail fuel market describes the situation in which retail prices are adjusted quickly in case of positive shocks in the wholesale costs, whereas the adjustment is much slower in case of negative ones. This asymmetry in the reaction of retail operators is captured by the well-known expression rockets and feathers. By relying on a reduced version of a database used in Moral and Gonzalez (2019) containing the series of diesel prices in Spain and Brent prices for the period 08/2014-06/2015, we address the following research question: how did the fuel prices of the retail gas stations in a subset of Spanish provinces react in this period to changes in the price of Brent? In order to answer this question, we construct a pricing equation that takes into account all the possible factors that can affect pricing with the aim of isolating the effect of negative shocks and the effect of positive shocks in the price of Brent on the price of gasoline of the various Spanish operators. Then, we check whether the difference between these two effects is statistically significant to see whether there were asymmetric reactions. Furthermore, since the common rocket and feathers phenomenon could be considered as a collusive device, and since in the period covered by the database a cartel was active among the main fuel companies in Spain, we also investigate the relation between asymmetric pricing and competition.

Conclusions

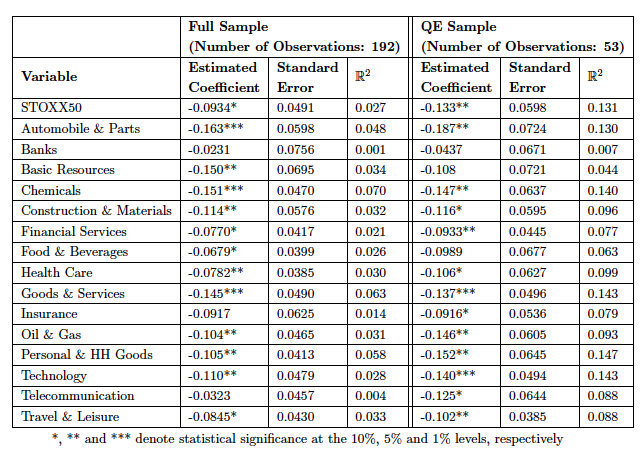

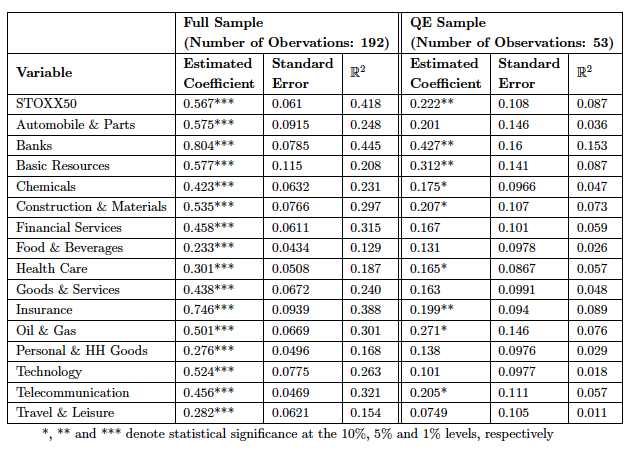

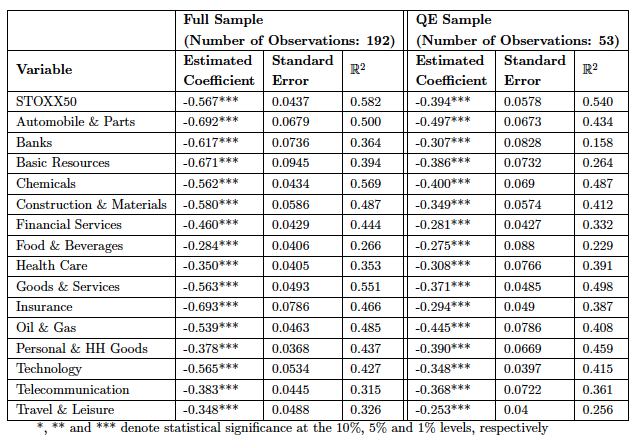

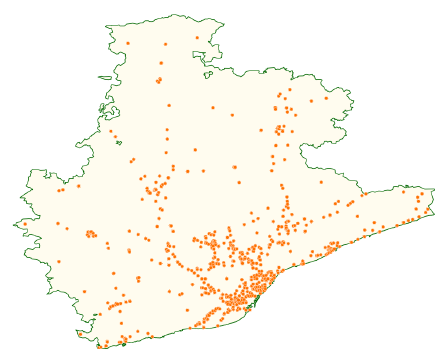

The aim of our project was to capture the presence of asymmetric pricing in nine Spanish provinces between 2014 and 2015 by taking into account the fact that during the period considered the CNMC fined five of the largest oil companies in Spain for collusion. To do this, we estimated an Error Correction Model for each province by accounting for both panel heterogeneity and cross-sectional dependence to capture both the short-run and the long-run relation between the retail diesel prices and the Brent price.

Our results show that there exists a correction mechanism that pushes the retail prices back to the long-run equilibrium relation with the Brent in case of shocks, even if the magnitude of the correction may be overestimated potentially because of the pattern of the retail fuel price in the period before the fine of the CNMC became public.

As far as the short-term adjustments are concerned, the results are less clear because of the lack of significance of most of the coefficients; this is potentially due both to the presence of imperfect collinearity arising from issues with the lag selection in each province as well as to the already mentioned patterns of the diesel prices. Furthermore, as to what concerns the effect of the fine of the CNMC, the results show that in many provinces there is some variability in the pricing of the gas stations after February 2015 that is not accounted for in the rest of the model. We may not confidently state that this is entirely due to the fine of the CNMC: in fact, the related coefficient may capture some variability due to the attempts of firms of recovering the losses incurred before the fine was issued. Consequently, we suggested that we may need to first solve the issue of the lag selection and then, if the effect of the fine is still significant, we may eventually add some control for the profitability of the firms, even if this would imply expanding the database because of the absence of variables capturing the evolution of profits of the firms observed.

To conclude, although our analysis may still need some refinement especially in the lag selection procedure, we suggest that the relation between asymmetric pricing and competition is worth exploring. In addition, it would be also interesting to understand whether aggregating the data in the database we used at a weekly level, for instance, would lead to different estimates and insights or would simply lead to biased findings as suggested in the literature.

Connect with the authors

- Silvia Brumana, Economics Intern at the UK Competition & Markets Authority (CMA)

- Roger Medina, Senior Research Fellow at the Ostrom Institute

About the BSE Master’s Program in Competition and Market Regulation