Editor’s note: This post is part of a series showcasing BSE master projects. The project is a required component of all Master’s programs at the Barcelona School of Economics.

Abstract

Whereas monetary policy in the euro area is conducted by one single authority, the European Central Bank (ECB), the real effects of these decisions provoke different reactions among the set of targeted countries. One common explanation for this finding is structural heterogeneity across the members of the eurozone. The paper assesses how commercial bank interconnectedness – as a specific source of structural heterogeneity – affects the propagation of common monetary policy shocks across the euro countries between 2003 and 2018. While recent research has found that bank interconnectedness can counteract the contraction in loans resulting from a monetary policy tightening in the US, evidence on the effects in the euro area is scarce. The paper tests this hypothesis empirically by constructing a panel data set for the original euro area countries, creating a measure for country-specific bank interconnectedness, and by identifying an exogenous monetary policy shocks based on high-frequency data. Employing local projections we find evidence that – in accordance with the theoretical model we discuss – a contractionary monetary policy surprise leads to a reduction in the supply of corporate and household loans in countries with a low degree of interconnectedness. Conversely, when the banking sector is highly interconnected, the impact of monetary policy is reduced or even counteracted. This implies that a common monetary policy shock can have heterogeneous effects among countries of the euro area, depending on the degree of interconnectedness of their banking industries. These results are robust to the inclusion of a wide set of controls and alternative shock specifications.

Conclusions and Key Results

Standard theory, assuming that the balance sheet transmission channel is at play, suggests that an increase in the interest rate reduces the value of pledgeable assets held by firms and households. This reduction in the borrowers’ creditworthiness consequently induces banks to constrain their amount of lending. A higher degree of interconnectedness of the banking sector, however, makes banks less sensitive to changes in the value of the collateral posted by borrowers since loan portfolios can be traded among banks with different risk exposures. Thus, when banks are highly interconnected, the reduction of the loans supply after contractionary monetary policy is expected to be smaller and the effects of monetary policy are likely to be less pronounced.

The paper tests this hypothesis for the eurozone using local projections and a panel dataset of 12 euro-area countries in the period between 2003 and 2018. The eurozone constitutes an excellent subject to study: It exhibits significant variation of bank interconnectedness – both across time and countries – which makes the hypothesis of bank interconnectedness as a determinant of heterogeneous reactions to monetary policy particularly relevant.

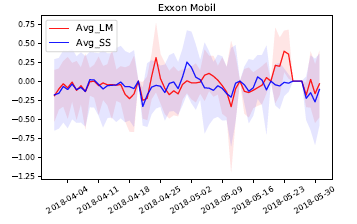

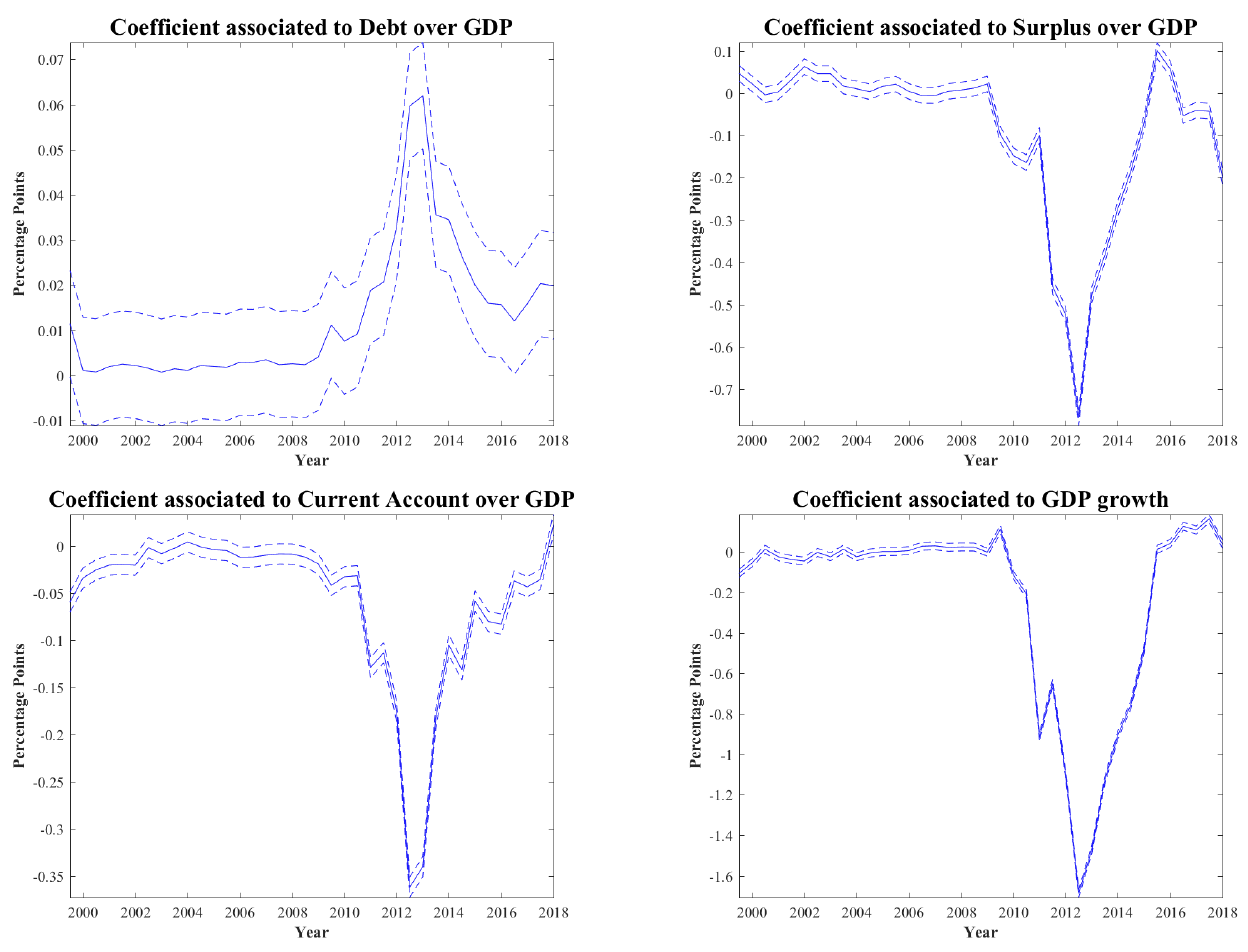

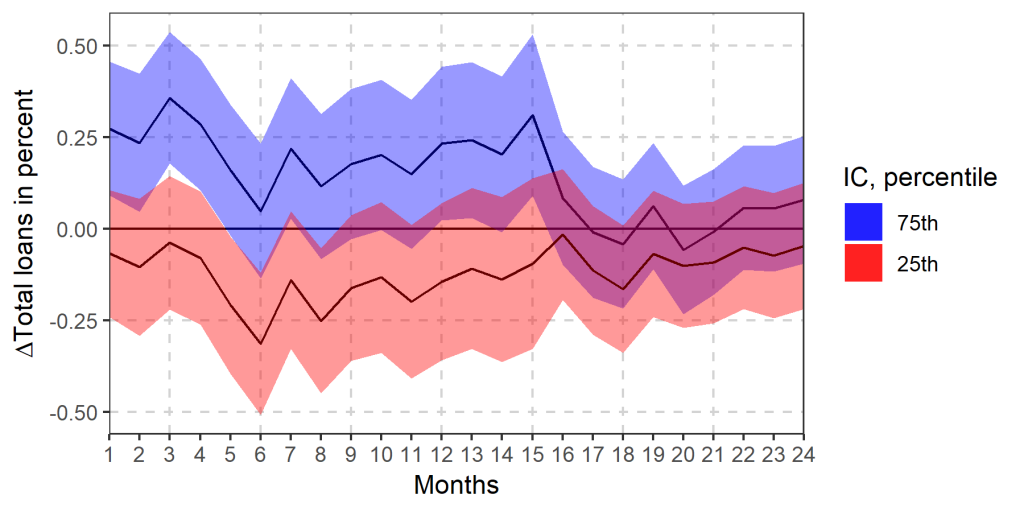

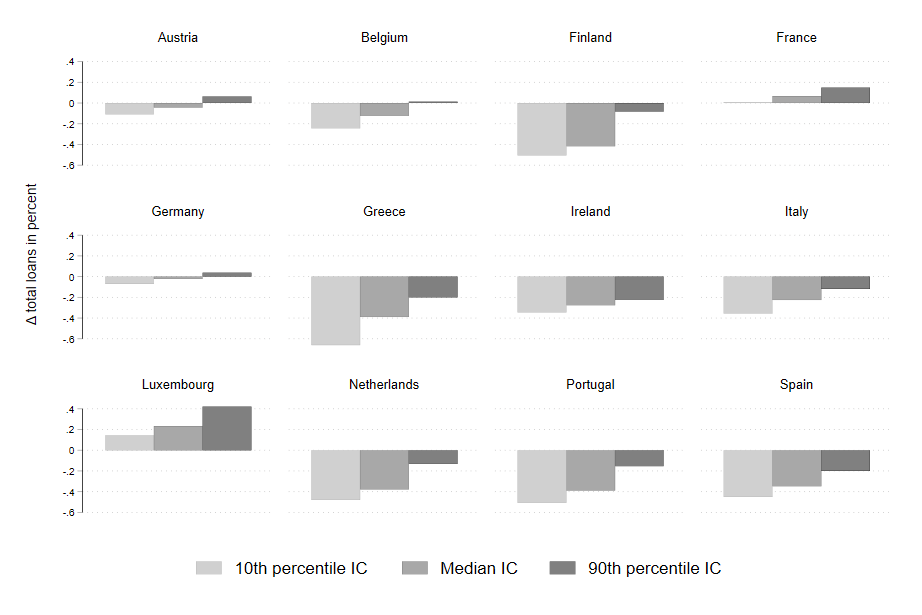

The key findings of the paper are that interconnectedness is in fact an important driver of heterogeneity in the transmission of monetary policy in the eurozone. More precisely, the analysis shows that when bank interconnectedness is low, contractionary monetary policy leads to a reduction in lending. In countries with highly interconnected banking sectors, however, the paper documents that the impact of monetary policy on loans may be offset. Even more so, our findings suggest that the effect of monetary policy may even be reversed at certain points in time after a monetary policy shock (see Figure 1). More generally, these effects seem to persist for approximately 15 months and hold for both household and corporate loans. A potential conjecture for the observed increase in loans, when bank interconnectedness is high, could be that contractionary shocks induce lending from highly interconnected core countries to countries with low bank interconnectedness in the European periphery.

Additionally, higher interest rates may induce banks to increase the loan supply due to higher potential returns in a context of efficient risk-sharing. The analysis also suggests that cross-country variation of bank interconnectedness, in particular, plays an important role in explaining heterogeneous responses to monetary policy. Muting the cross-country variation, by contrast, delivers effects that are still in line with the theory but which turn out to be statistically insignificant. In other words, accounting for cross-country heterogeneity is essential. Moreover, employing alternative specifications, the results are found to be robust to using alternative shock measures, including additional controls, and excluding outliers.

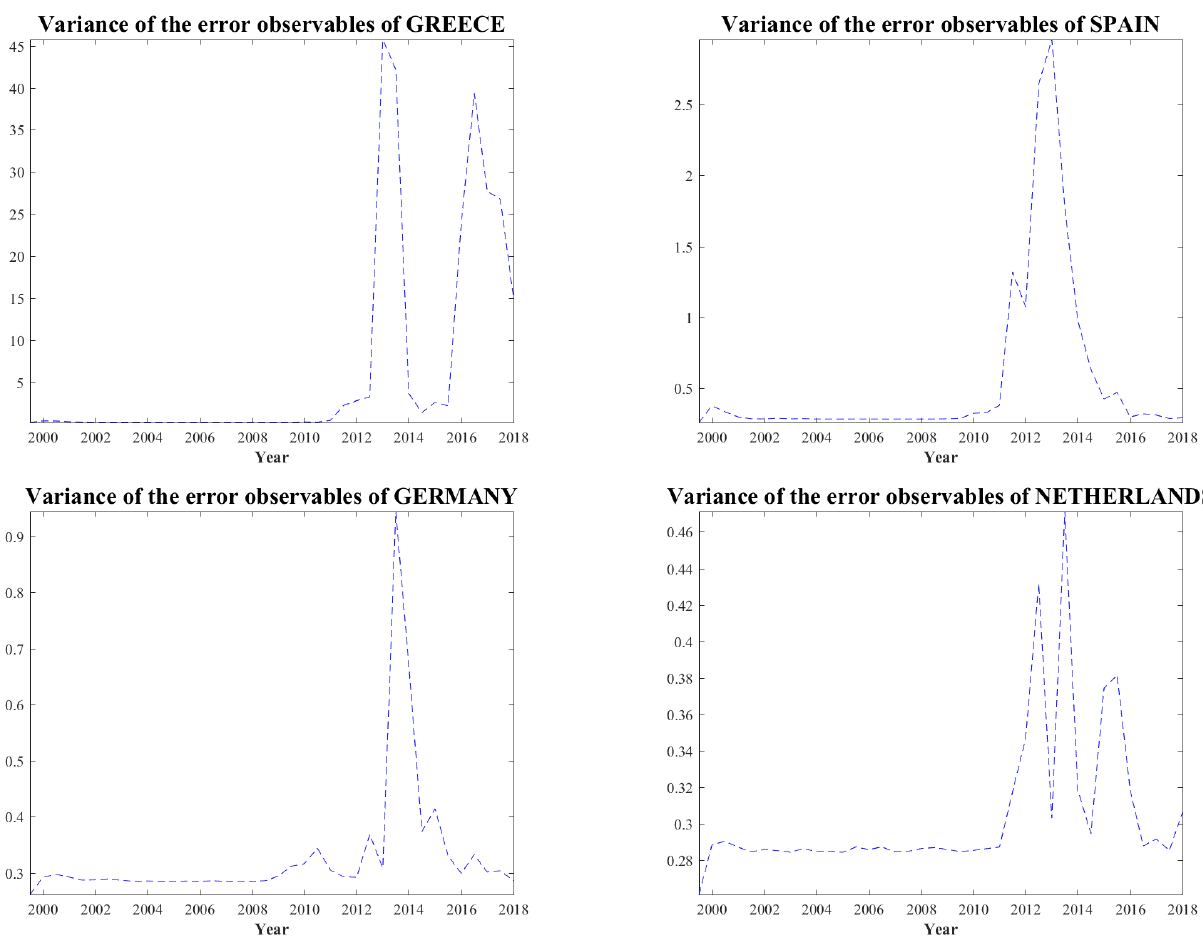

Using our estimates to predict the country specific responses to a monetary policy shock, we show that countries are expected to react very heterogeneously. While Greece, for instance, is predicted to experience a contraction of loans after an interest rate hike at its 10th, 50th, and 75th percentile of bank interconnectedness, the effect of monetary policy is almost completely offset in Germany or Austria (see Figure 2).

In sum, the analysis contributes to the understanding of how monetary policy is transmitted across countries in the euro area. The paper shows how heterogeneous responses can be explained by the variation in countries’ individual levels of bank interconnectedness. Furthermore, it provides a potential explanation for why recent research has found rather modest responses of the loan supply to monetary policy. Such observations appear inevitable given that many countries display levels of interconnectedness at which the reaction of loans to monetary policy is predicted to be only small or even nonexistent. Only by incorporating interbank lending into the analysis, sizable effects of monetary policy become apparent again.

Authors: Sofia Alvarez, Michael Barczay, Guadalupe Galambos, Ina Sandler, and Rasmus Herløw Schmidt

About the BSE Master’s Program in International Trade, Finance, and Development